Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

Determine how much you need to save over time to finance your dreams. Include an emergency fund in your financial goals.

Why do I need an Emergency Fund?

What Is An Emergency Fund?

Along with the simple act of creating a savings account, one of the most important things that you can do with your money is to create an emergency fund or contingency fund. An emergency fund or contingency fund is an account that you should contribute to regularly that is meant to act as a safety net for you and your loved ones should something unexpected happen. This can include an untimely death, an unexpected injury or illness, or other significant expenses incurred, such as a car repair.

It is advisable that the emergency or contingency fund—the amount of money that can be drawn upon quickly to cover major unexpected adverse events—should be equivalent to 3 or more than 6 months of a family's average monthly expense.

It is important to understand that emergency funds should not be touched until the time in which a crisis arises as tapping it before then undermines what it represents.

How To Create An Emergency Fund?

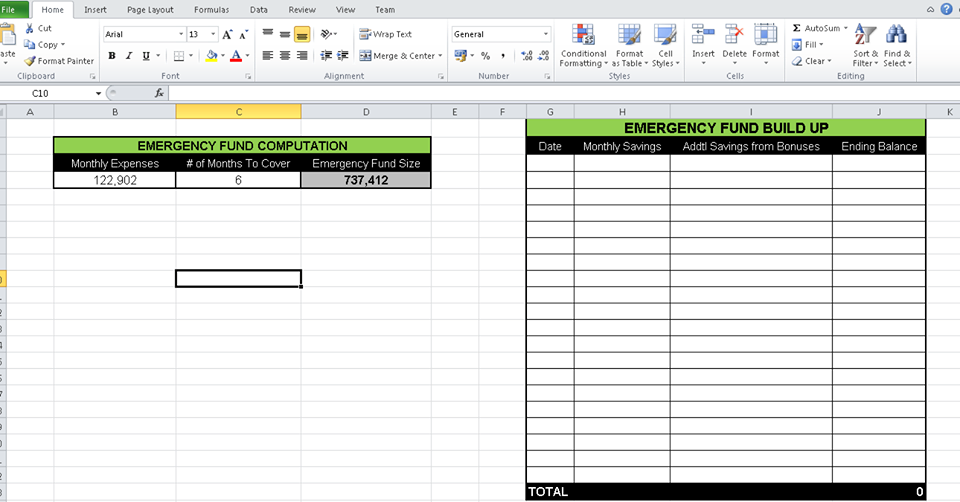

Here are a few steps to build your emergency fund: Establish Your Goal Remember SMART (S-pecific M-easurable A-chievable R-ealistic T-ime-Bound). First thing to do is, check your cash flow and evaluate how much you can set aside per month towards your emergency fund. Plan To Meet Your Goal If you decide that you’ll need Php 100,000 to get by for a few months in a worse-case scenario, make a reasonable plan to achieve that goal. Allocate Your Initial Low Target Set a certain percentage amount of your income every month to build your emergency cover over a period of months. Much better if you will allocate more to the emergency fund when you earn more money. So, What Is The Formula? (Let's assume sample figures)

MONTHLY EXPENSES ✖️ # OF MONTHS TO COVER = EMERGENCY FUND SIZE

Simple, isn't it? Setting up an emergency fund is more than just being practical, it’s being responsible.

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |