Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

SSS PESO Fund, a voluntary provident fund for members. Save Now! Invest In Your Future! Why Is Saving For The Future Important? Saving for the future allows us to enjoy a comfortable retirement by enabling us to:

The future, however, is getting more expensive as family dynamics are changing, people live longer, and an active lifestyle is adopted. When Should A Person Start Saving? Saving should be done consistently and it is a priority, as early as possible, even in small amounts. Time is of the essence, especially if the retirement fund offers compound interest, such as the SSS P.E.S.O. Fund What Is The SSS P.E.S.O. Fund? The SSS P.E.S.O. Fund (Personal Equity and Savings Option) is a voluntary provident fund offered exclusively to SSS members in addition to the Regular SSS program. Through this program, members who have the capacity to contribute more are given the opportunity to save more in order to receive higher benefits in the future. Why Is The SSS P.E.S.O. Fund A Good Investment? The program provides an option for SSS members to save for their retirement through:

Who Can Join The SSS P.E.S.O. Fund? The program is open to all employees, self-employed (SE), voluntary (VM), and OFW members who have met the following qualifications:

How Can An SSS Member Join The SSS P.E.S.O. Fund? SSS members can enroll in the program over-the-counter at any SSS branch, or online via My.SSS at www.sss.gov.ph. When Does Membership In The SSS P.E.S.O. Fund Start? Membership begins with the payment of the first contribution to the P.E.S.O. Fund. How Will A Member Contribute In The SSS P.E.S.O. Fund? Contributions to the program may be made by the member any time, ensuring only that a corresponding contribution in the Regular SSS program is also made for the same month. For SE, VM, and OFW members, said contribution in the Regular SSS program should be based on the maximum Monthly Salary Credit (MSC). Each member shall be allowed a maximum contribution of P100,000 per annum and a minimum of P1,000 per contribution How Is The SSS P.E.S.O. Fund Allocated? The contributions and earnings of a member shall be allocated to three (3) types of accounts:

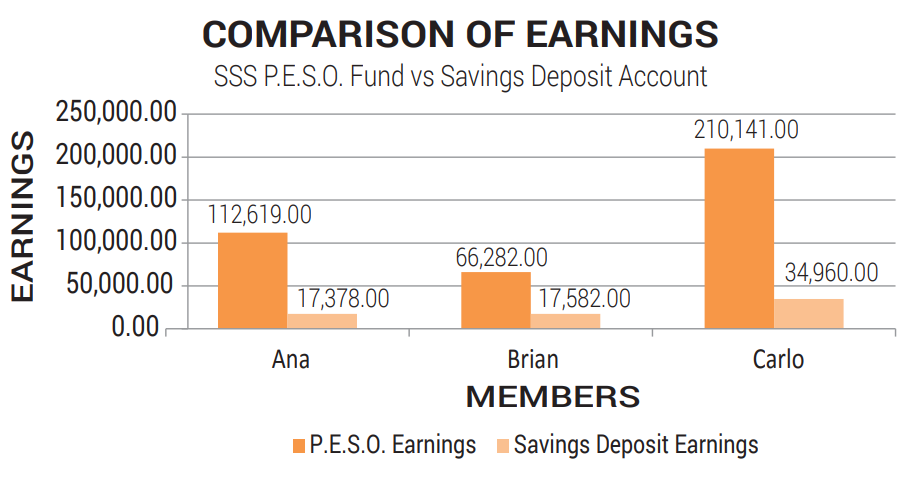

Are Withdrawals From The SSS P.E.S.O. Fund Allowed? No withdrawals are allowed from the retirement/total disability account. Withdrawals from the fund shall be allowed only from the Medical (25%) and General Purpose (10%) Accounts. Withdrawals within the 5-year retention period shall be charged with corresponding penalty and service fees. When Can A Member Receive Benefits From The SSS P.E.S.O. Fund? The member will receive benefits upon filing a retirement, total disability or death claim under the regular SSS program. Retirement or total disability benefits, which consist of the member's contributions and earnings from the SSS P.E.S.O. Fund, may opt to receive this in monthly pension, lump sum or a combination of both. Death benefits shall be paid in lump sum to the member's beneficiaries. Comparison Of Earnings (for illustration purposes only) The table shows a comparison of earnings from contributions made by three (3) SSS P.E.S.O. Fund members with the following details:

Brian has invested more than twice as much as Ana, yet Ana’s earnings are higher. She saved for just 10 years while Brian saved for 24 years.This is the power of compound interest: the investment earnings of Ana in her 10 early years of saving is working to her advantage. Brian can’t equal the earnings of Ana, even if he saves for an additional 20 years.

The best scenario is that of Carlo, who begins saving early and doesn’t stop until retirement. Note how the amount he has saved is higher than that of Ana’s or Brian’s. Slow and steady annual investment and most importantly, beginning at an early age, is the key to a more secured future. Compound interest works well for those who start early. It pays to start saving now. My Personal Opinion: Like Modified PAGIBIG II (MP2), SSS P.E.S.O. Fund is one of the good money builders for savings especially for retirement purposes.

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |