Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

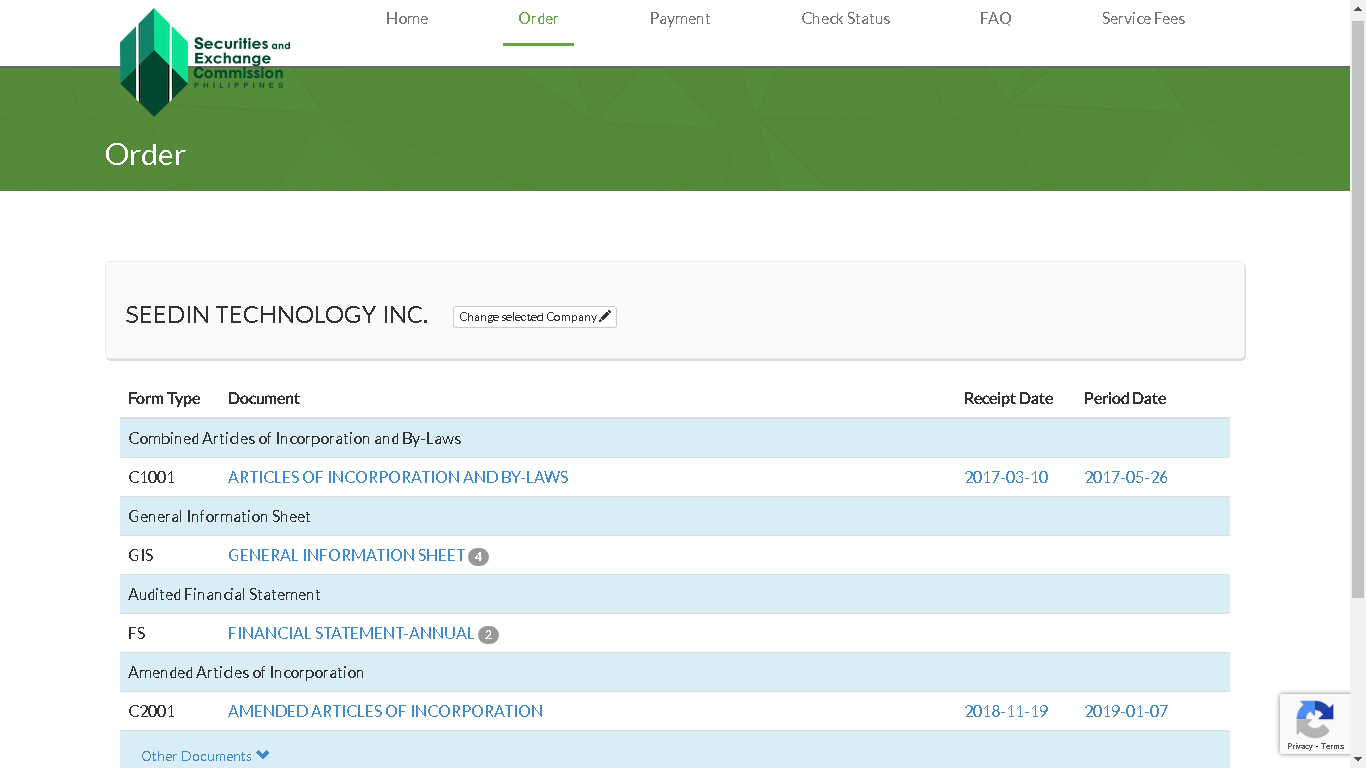

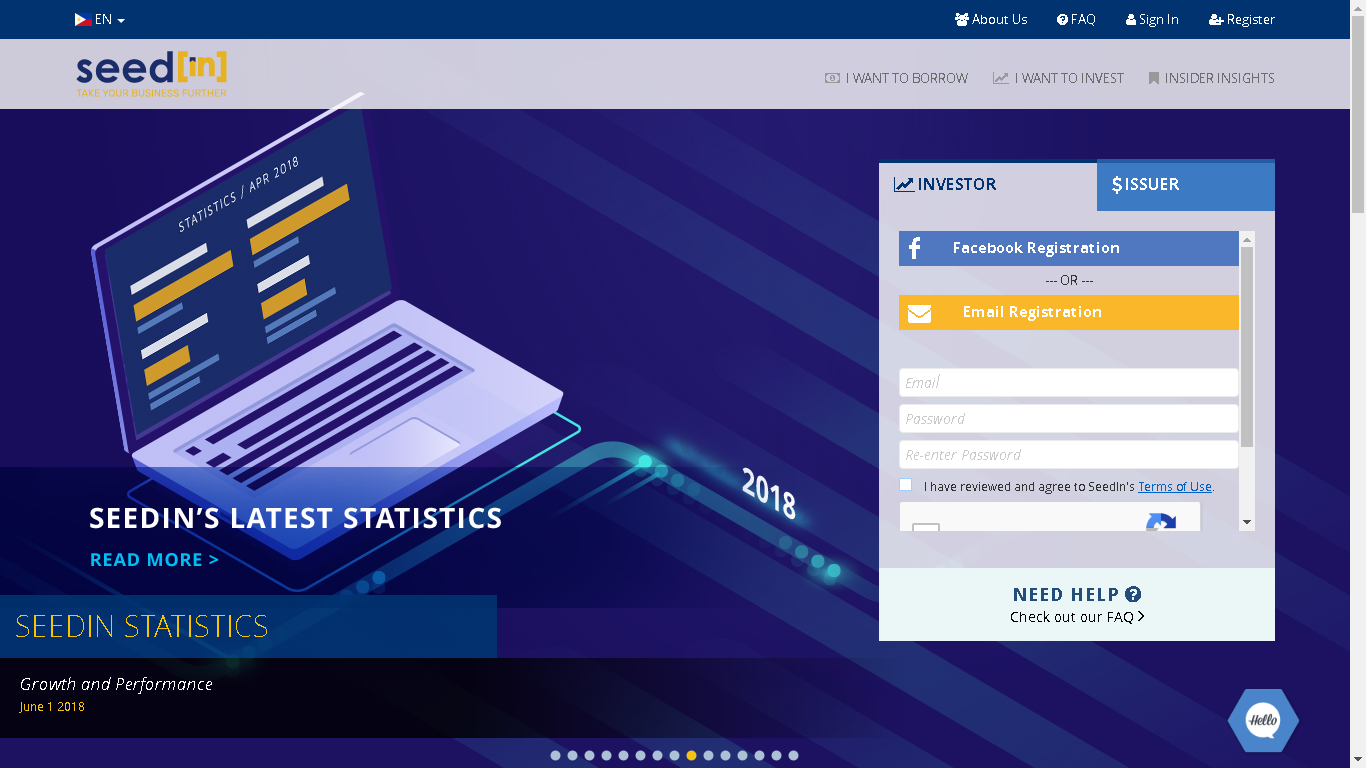

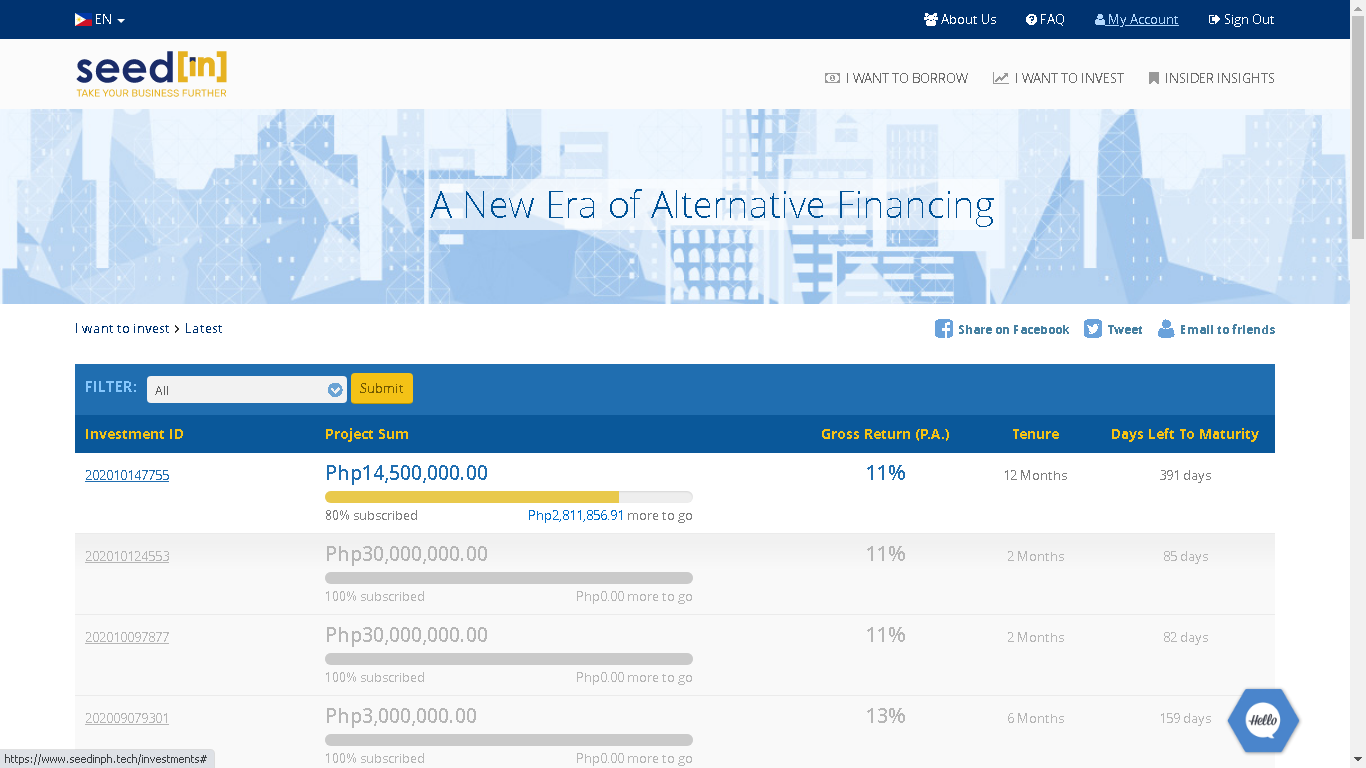

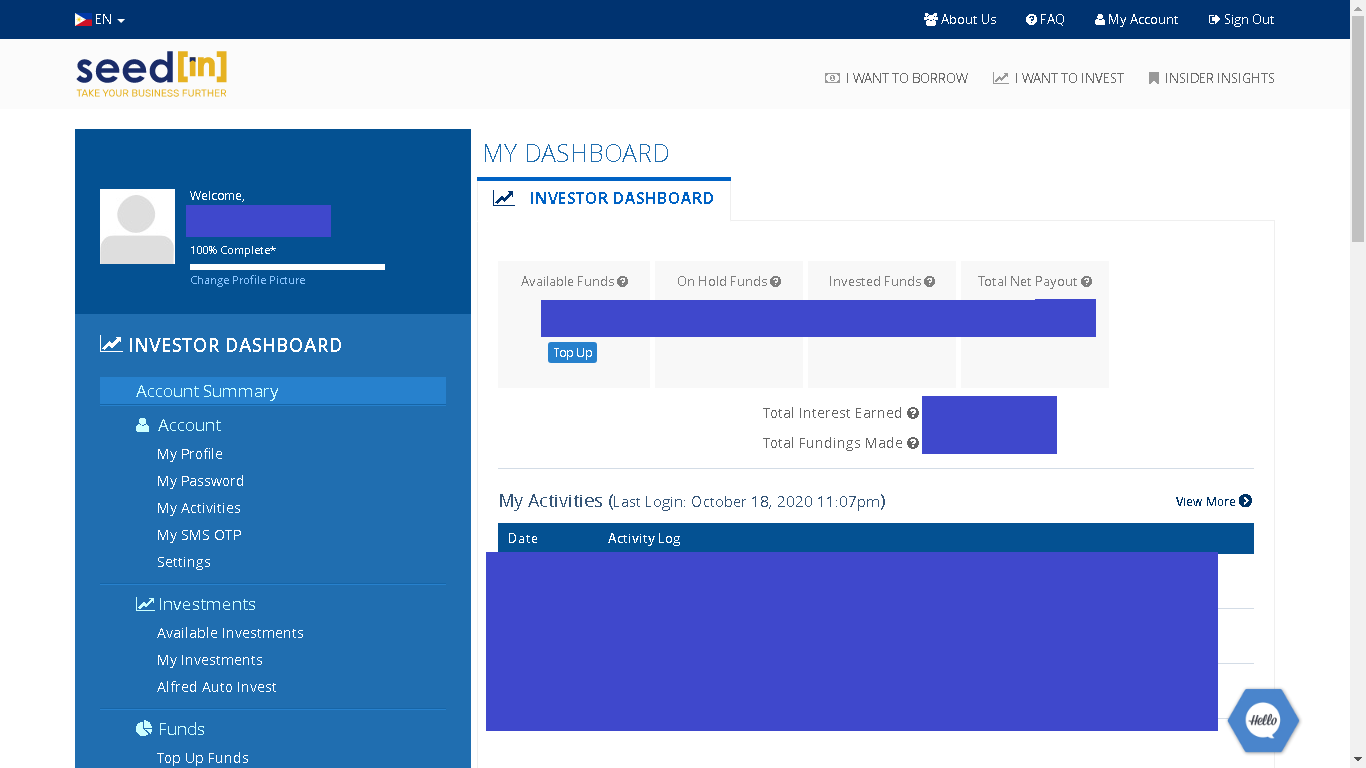

Remember the 4 Golden Rules of Investment: Invest early, invest regularly, invest long-term, and invest using diversification. There are lots of financial instruments that will help you to reach time and financial freedom. As the old saying goes, "Do not put all your eggs in one basket." Diversification helps manage risks! Have you ever heard the word crowdfunding? Maybe it's a foreign word to you. Crowdfunding is the practice of funding a project or venture by raising small amounts of money from a large number of people, typically via the Internet. SeedIn is one of the crowdfunding investments that you may consider in your investment portfolio. So what is SeedIn, by the way? Diversification is protection against ignorance. What is SeedIn? SeedIn is Southeast Asia’s leading business financing platform where local businesses seeking short-term financing connect with business entities seeking short-term investments. It is registered with Securities and Exchange Commission (SEC) (Company Registration #CS201717259) and complies with the rules and regulations governing Crowdfunding, under SEC Circular No. 14 s.2019. SEC grants SeedIn Technology The Securities and Exchange Commission (SEC) has allowed SeedIn Technology, Inc. to act as crowdfunding intermediaries and operate crowdfunding portal, providing the country’s small, medium, and emerging enterprises (SME) with more funding options. In its meeting on February 23, 2022 the Commission En Banc approved the respective application of SeedIn Technology for registration as crowdfunding intermediaries, subject to the companies’ compliance with certain remaining requirements. The Commission granted SeedIn Technology a permanent license in lieu of a oneyear provisional license. The company’s operations, however, will be subject to frequent monitoring by the SEC Markets and Securities Regulation Department for one year. Why invest with SeedIn? SeedIn provides short- term tenured investments and offers competitive returns with monthly interest rates repayments. Additionally, projects are scrutinized under strict credit risk assessment and are often secured by collaterals. Why SeedIn's short-term investment? Short-term investments make the most of your liquid funds in a short period. As such, you could fully utilize liquid funds that are required shortly to invest in SeedIn to earn high returns in the meanwhile. Short-term investments provide more liquidity than long-term investments due to quicker turn-over rates, allowing more profits on your assets to remain liquid and reusable. However, it offers little or no interest. In contrast, SeedIn returns are higher than Traditional Financial Service Products with similar tenures. What are the required document(s) for an Individual Investor? Customer identification requirements may include, but not limited to, knowing their name, address, nature of work, date, and place of birth, nationality, and their contact numbers The Bangko Sentral ng Pilipinas (BSP) recognizes the following IDs: Passport, Driver's License, SSS Card, GSIS E-Card, NBI Clearance, PRC ID, Police Clearance, Postal ID, Voter's ID, Barangay Certification, Senior Citizen Card, Overseas Workers Welfare Administration (OWWA) ID, OFW ID, Seaman's Book, Alien Certification of Registration (ACR), Government Office and GOCC ID, e.g. Armed Forces of the Philippines (AFP ID), Home Development Mutual Fund (HDMF ID), Certification from the National Council for the Welfare of Disabled Persons (NCWDP), Department of Social Welfare and Development (DSWD) Certification, Integrated Bar of the Philippines ID, Company IDs issued by private entities or institutions registered or supervised or regulated by either BSP, SEC or IC Who qualifies as a Corporate Investor? Any Philippine-registered corporate body (with DTI/SEC Registration) can be qualified as a corporate investor. What are the required document(s) for a Corporate Investor? A certified true copy of the latest DTI Certificate, or SEC Certificate with General Information Sheet (GIS). How do Investors submit the required documents? Retail/Qualified Investors can upload the documents via our website as prompted during the registration process. How long does it take for the registration to be approved? After all the required documents are submitted, SeedIn will review the documents and registration can be approved within 3 working days. Can I still register with SeedIn if I am not a Philippines citizen? Yes, but it depends on your nationality and special circumstances. Kindly contact SeedIn for further information. Otherwise, SeedIn only restrict to investors who are Philippine Citizens to participate in their product offerings. Retail/Qualified Investors who fall under this category must have both a Philippine-based mobile number and bank account in order to qualify. My contact information has changed, how do I go about updating it? Due to security reasons, sensitive information about investor profiles cannot be changed. They are namely your registered email address, bank details, and your mobile number. To make a change, please get in touch with SeedIn Philippines. What charges are applicable to Investors? In consideration of SeedIn providing the Platform and Services to you, as a Retail/Qualified Investor, SeedIn charge a Risk Management Fee of at least 10% of the Interest Earned. The Risk Management Fee shall be deducted from the proceeds of repayment of the Participation Amount and Dividends due to you pursuant to the terms of the Participation Agreement. The proceeds, net of the Risk Management Fee, shall be deposited into the Escrow Account and held in escrow on your behalf. Proceeds are subject to a 20% Creditable Withholding Tax (CWT). These fees are charged to cover the costs associated with the administrative, servicing, and compliance. Kindly refer to SeedIn's Terms of Use for full information. How to register as an Investor? 1. Go to SeedIn's Website. 2. There are two ways to register. Use our homepage registration “Investor tab,” and register using FB/Email registration or select the Register button at the top - right corner of the page. Register account type as Investor and complete registration process. 3. A confirmation message will be sent to your email once you have successfully registered. How to top-up/fund your Account? 1. Once you have successfully login, select My Account the select Dashboard. 2. Select the Top Up button on the My Dashboard. 3. Scroll down and select Your Payment Type:

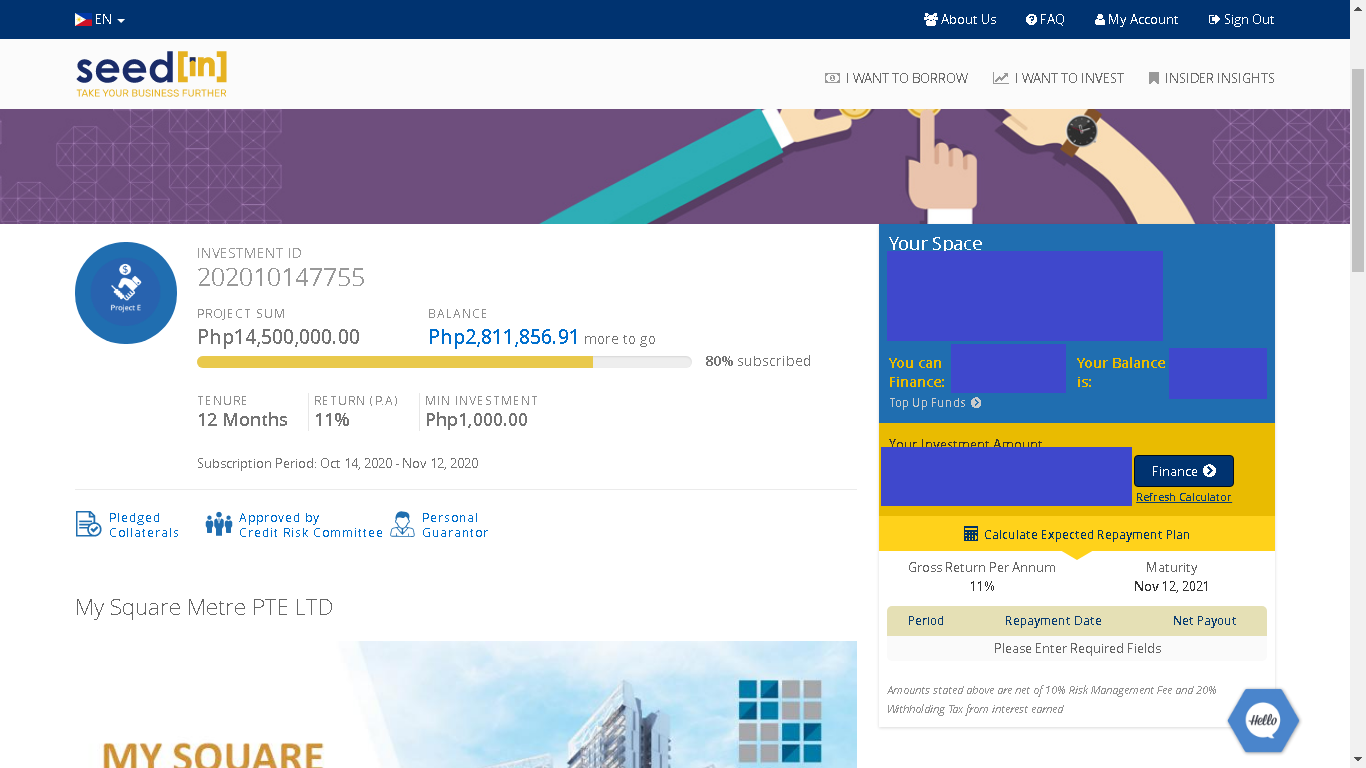

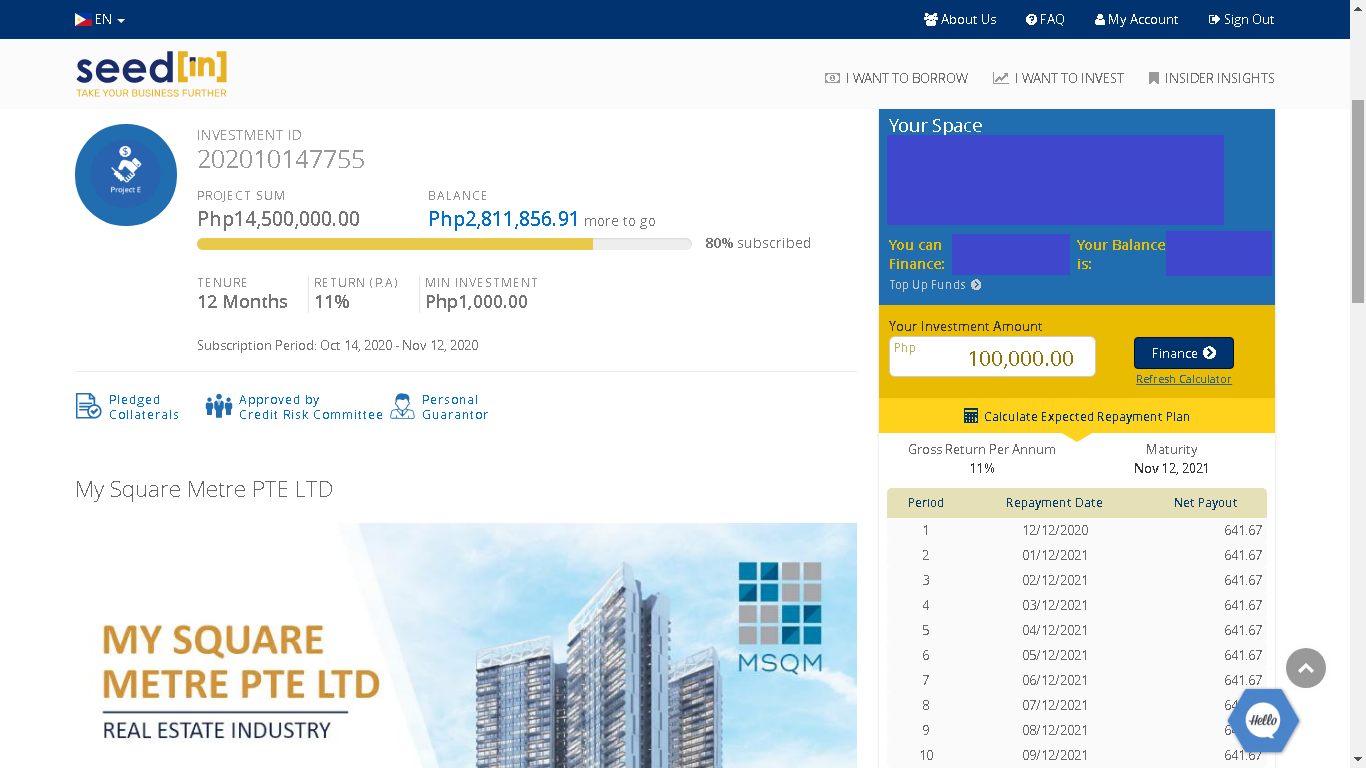

4. Payment Type: Bank Transfer (for our example only). Enter the details and attach an image of the transaction. When done, select the Update Button. Note: Once approved by SeedIn, your account will be credited by the amount deposited to SeedIn bank account. You may now invest in the various investments published on the SeedIn website. How to Invest? 1. Once signed-into your account, you will be redirected to the page that shows all the published investments. Select your chosen investment. 2. After selecting an investment, you will be redirected to the investment’s page. Enter the amount you wish to invest in the box then select the Finance Button. 3. You may select a refresh calculator to show your schedule of repayment for your investment amount before you select the Finance Button. Note: All of the investments have different minimum investment amounts. Minimum investment or a sum larger should be invested.

4. After selecting the Finance button, a window will appear. Enter the One Time Password (OTP) sent to your registered mobile phone number and select Proceed. A prompt will appear to confirm that the transaction was successful. Congratulations! Happy Investing!

2 Comments

Mikhail Jethro Montes

12/26/2023 04:26:02 am

Is Seedin another ph.moneymatch? Bigla na lang kasi nawala si moneymatch eh investor din ako doon.

Reply

Hi Mikhail, sorry, I am not familiar with and have never heard of ph.moneymatch ever before.

Reply

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |