Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

Don't just save your money, learn to invest. Make it grow!

Are you looking for a way to diversify your investment portfolio? Diversifying your portfolio helps you mitigate investment risks and make sure you achieve your financial goals without unnecessarily endangering your funds.

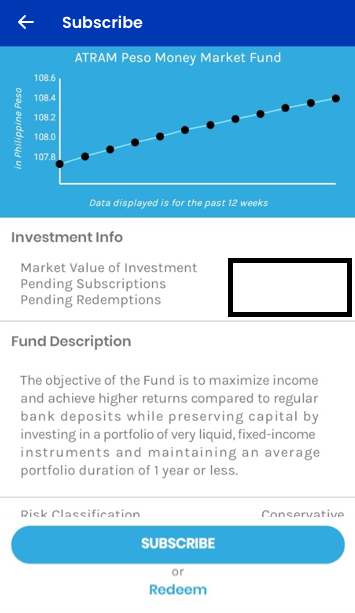

Diversify your investment portfolio with GInvest of GCash App! What is GInvest? GInvest is the investment marketplace feature of the GCash App. This service allows users to invest in various investment funds from their partner—ATRAM Trust. Who is ATRAM Trust Corp? ATRAM Trust Corporation (ATRAM Trust) manages some of the best performing funds in the Philippines. ATRAM Trust is the first stand-alone trust corporation in the Philippines. It received its license to operate in October 2016 from the Bangko Sentral ng Pilipinas (BSP). ATRAM Trust provides and manages the funds available in GCash Invest Money.

Why invest with GInvest?

There are lots of reasons why to invest with GInvest. Here are the few reasons: Investing Made Easy! Hassle-free

Affordable

Best Partners

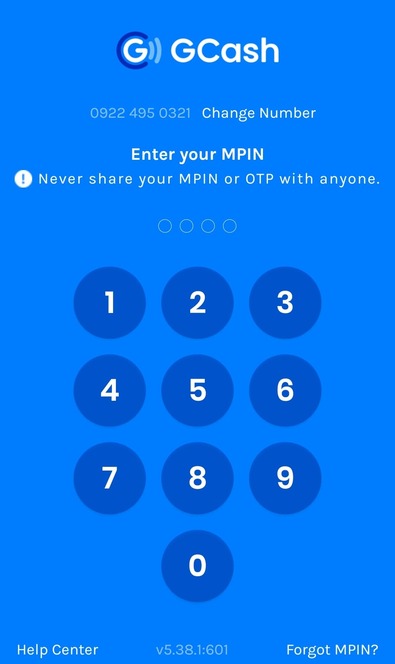

How can I apply for a GInvest Account? 1. Login to your GCash Account.

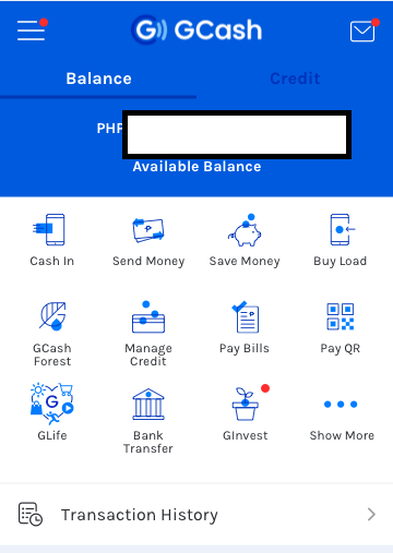

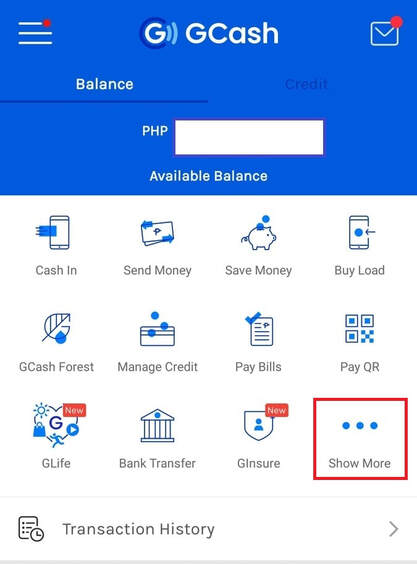

2. Tap "GInvest" on the main screen or dashboard.

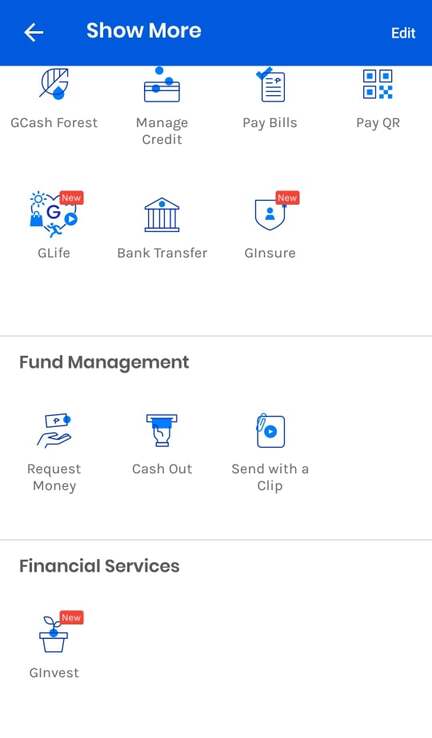

Note: If it's not on your main screen or dashboard, you can find it in the "Show More." Tap it and then scroll down. You will find it under "Financial Services."

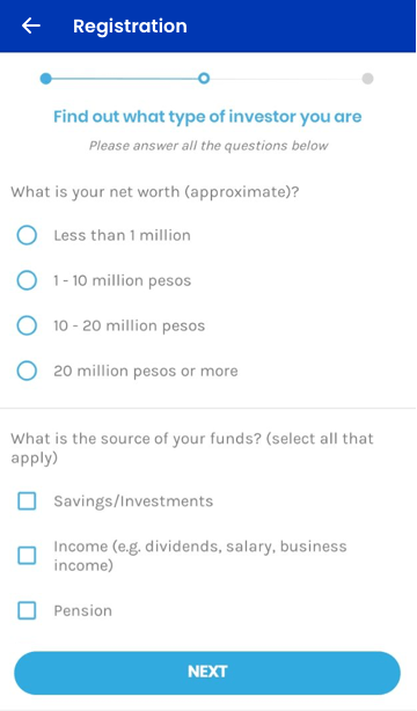

3. Register and take the Risk Profile Questionnaire.

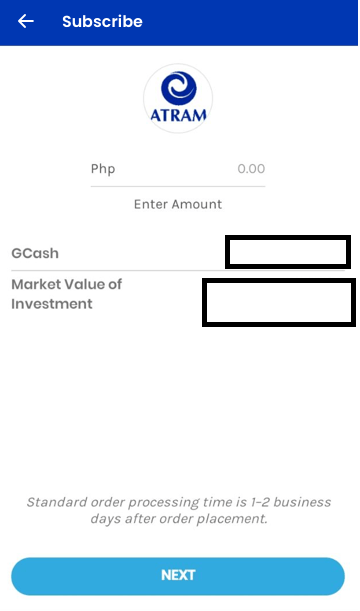

4. Once approved, subscribe to an investment fund. To "subscribe" means to put your money in the fund by buying units of it. Your subscription can take 1-2 business days to process.

5. Put money in your chosen investment. You can invest regularly by setting a reminder.

6. Track your investment and sell whenever you want. When you "sell," you get money for what your investment is currently worth. Selling can take 2-3 business days to process.

Can you retake the Risk Profile Questionnaire and/or change your Risk Appetite on GInvest?

Retaking the Risk Profile Questionnaire (RPQ) to update your Risk Appetite is currently not available on GCash. The Bangko Sentral ng Pilipinas (BSP) mandates that investment account owners should retake the RPQ every 3 years from the account opening date. You will receive a notification from GCash if you are required to update your Risk Appetite. Note: You may invest in funds that have a higher or lower risk classification compared to your risk profile. You will only need to acknowledge a waiver by clicking 'Proceed' if the funds have a higher risk classification than your risk profile. Tips! Fund managers recommend for investors to invest only up to 20% of their investment portfolio in more aggressive funds and to maintain 80% of investments in funds that are within their Risk Appetite/Profile. Are there fees in using GCash GInvest? There are no fees to be charged from your investments every time you transact. There are also no minimum holding periods. Investing in GCash has 0 fees. What is Net Asset Value per Unit (NAVPU) and how is it determined? Net Asset Value Per Unit or NAVPU is the unit price of a fund. The product provider computes it by dividing the fund’s overall value by the total number of units the fund has. It may increase or decrease daily, depending on the fund’s performance in the market. Is there a possibility of losing my money? Is my investment guaranteed? Investing in financial markets always comes with some level of risk. On GInvest, that risk is reduced because the funds are professionally managed. This means less risk, in contrast, to directly investing in the stock market. Note: When it comes to investing in financial markets, returns are not guaranteed. The market value of investments can also decrease depending on market performance. The funds are not deposits and are not insured by the Philippine Deposit Insurance Corporation (PDIC).

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |