Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

There is only one way to address cash flow crunches, and it’s planning so you'll prevent them beforehand.

Having a high-paying job is not as important as having personal control over your cash flow. Well, it is an advantage if you do have a high-paying job and know how to handle your finances.

But, too many people seem to be obsessed with how big their paycheck is. To be financially successful, we all need more financial education. And financial education begins with the basics of financial literacy. And one of the first things we need to know is, how do we manage our personal cash flow. If you feel that your finances have not improved after years of working, then you may have the wrong mindset about money. Your mindset determines your financial success. There are 2 ways of gauging your financial health. One is calculating and knowing your net worth and two is your personal cash flow. Do you know how much is your net worth and cash flow?

What is a Personal Cash Flow?

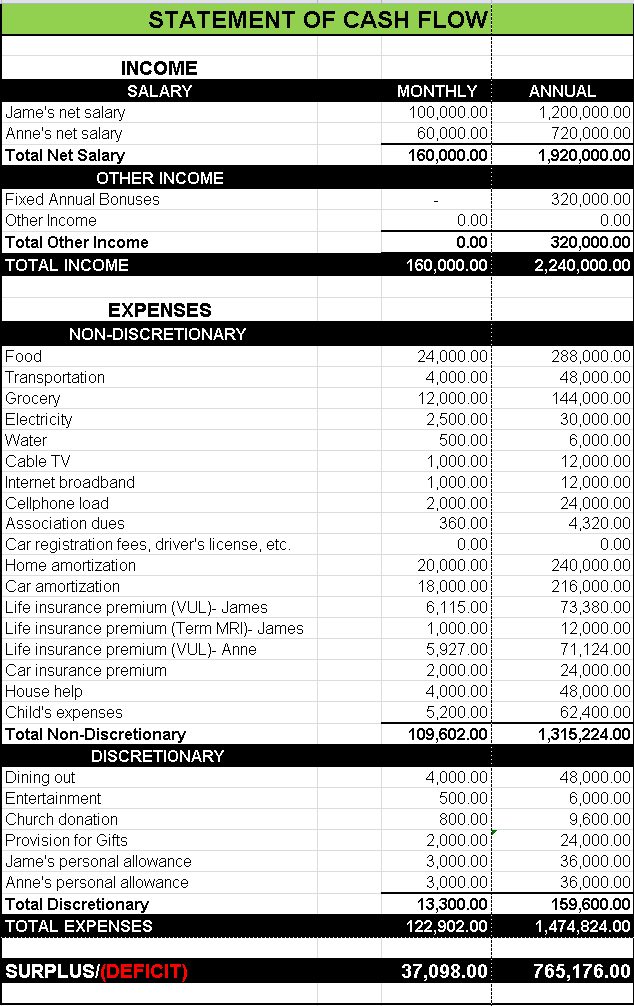

Your Personal Cash Flow is essentially your income minus your expenses over a particular period of your time—typically a month. If you would like to afford stuff without having to rely on loans, if you would like to grow your savings or maybe start investing, you would like to start with the essential: how you manage your finances. What is a Personal Cash Flow Statement? The personal cash flow statement measures your cash inflows (money you earn) and your cash outflows (money you spend) to work out if you've got a positive or negative net cash flow. Below is the sample Statement of Cash Flow.

Basics of Personal Finance

Needs or Non-Discretionary Needs are items that you simply got to survive. These are things like food, shelter, and clothing. They're the essentials. Needs also can be expanded to included things like utility bills and even minimum debt payments if you're in debt. Wants or Discretionary Wants are items that are nice to possess. They're not things that you simply got to survive. Sometimes needs become wants once you take your needs beyond the basics: for instance, if you purchase a home that's larger than you'll afford. Surplus or Deficit Surplus The quantity by which your income is bigger than your spending. Deficit The quantity by which your spending is bigger than your income. What to do if you have Surplus or Deficit? If you've got surplus or extra money:

If you've got deficit, you would like make changes to balance your budget:

The Bottom Line

If you've got more expenses than income, you've got a deficit. You need to find ways to reduce your spending or increase your income. Live Below Your Means! When you're still starting out in your job, when your salary is still small, when your money is still very scarce—that's the perfect time to invest. Never wait and say, "I'll invest when things are much better." Take the advice contained in an old Chinese proverb, "The best time to plant a tree was 20 years ago. The second best time is now." Secure your livelihood before your lifestyle. Establish your income stream before your expense stream. A Gift For You! You can download my free Personal Cash Flow template here.

4 Comments

Kris

7/28/2022 02:38:40 am

Hi, I am a full-time employee, and I only earn P 17,500 per month in the company I work for. Actually, it's too small because I still help with household expenses. I just want to ask for an idea or advice on how I can make more money. I hope you notice my comment. Thanks a lot.

Reply

Hello Kris, I want to share the 7:00 pm to 1:00 am strategy (for employees who want to earn more for their goals and dreams

Reply

Rey

8/10/2022 07:48:19 am

How about a company cash flows? Can a company show positive while facing financial troubles?

Reply

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |