Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

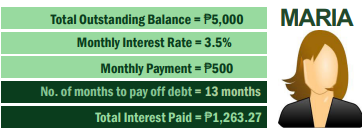

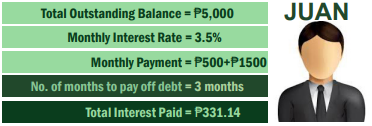

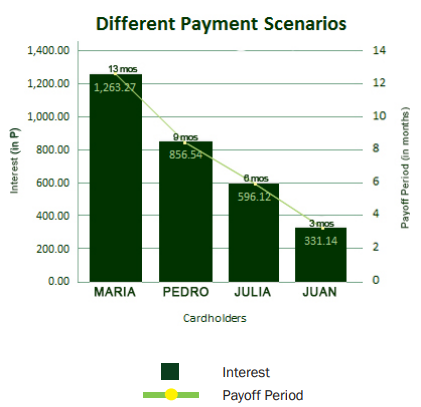

Are you using your credit cards wisely? If you can't pay in cash for an item, you can't afford it. Paying the Minimum Means Paying Interest to the Maximum Paying only the minimum amount due on your credit card bills look so easy on your budget, since you only have to pay a seemingly small amount. However, if you take into consideration the interest due, the amount you are actually paying may not be so insignificant at all. Below are different payment scenarios showing how much it will cost if you pay only the minimum due every month and how paying a little more than the minimum amount due can impact both the interest due and the payoff period. Different Payment Scenarios Assumptions Total Outstanding Balance (Principal) = Php 5,000 Interest Rate = 3.5%/month or 42%/annum Minimum Amount Due = Php 500 Scenario 1: Maria pays only the minimum amount due every month. Scenario 2: Pedro pays the minimum amount due plus Php 200 every month. Scenario 3: Julia pays the minimum amount due plus Php 500 every month. Scenario 4: Juan pays the required minimum amount due plus Php 1,500 every month. Foregoing illustration shows that paying only the minimum amount due would result in paying a significant amount of interests over time. Hence, doubling, or even tripling the costs you paid for the things you bought using your credit card. However, additional payments of at least Php 100 can significantly reduce the total interest to be paid, as well as the period of repayment. 5 Tips for Paying Off Accumulated Credit Card Debt Do you feel overwhelmed with your outstanding credit card debt? Has your accumulated balance spiraled out of control that you are now having difficulty paying it off? Below are 5 tips to help you manage your credit card debt level and regain control of your finances.

Set a Goal Establish realistic goals for paying off your accumulated balance to a manageable level. Monitor your progress (in person, through phone or online regularly to keep you on track. Create a Spending Plan Create a spending plan (weekly or monthly) for your income. This will help you live within your means and will give you a timeline on when you can reduce your outstanding balance. Trim your Expenses to Free Up Some Cash Keep a record of and categorize your spending to know where your money is going. Review your record and look for opportunities to cut your expenses (i.e., dining out, watching movies, etc.). This will free up some cash that you can use to pay off your outstanding balance. Pay Off First the Card with the Highest Interest Rate If you have outstanding balances with multiple credit cards, maximize payments on the credit card with the highest interest rate. Once fully paid, pay off the card with the next highest interest rate. This will save you on interest payments and help you settle your debts faster. Stop Using the Card Keep the card out of your wallet so you are not tempted to use it. Paying cash for purchases helps in making you conscious about your spending. If the problem is severe and if you are falling behind your bills, you may negotiate with your bank or creditor to be able to settle your obligation.

2 Comments

12/3/2020 06:58:15 pm

these are great tips! I'm glad to know that I am on the right track as I try to pay off my credit card debts.

Reply

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |