Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

An investor's worst enemy is not the stock market but his own emotions. Wealthy people invest first and spend what's left and broke people spend first and invest what's left. Build Your First Investment Porfolio Let your money grow, as fast as safely as possible. Take a picture!

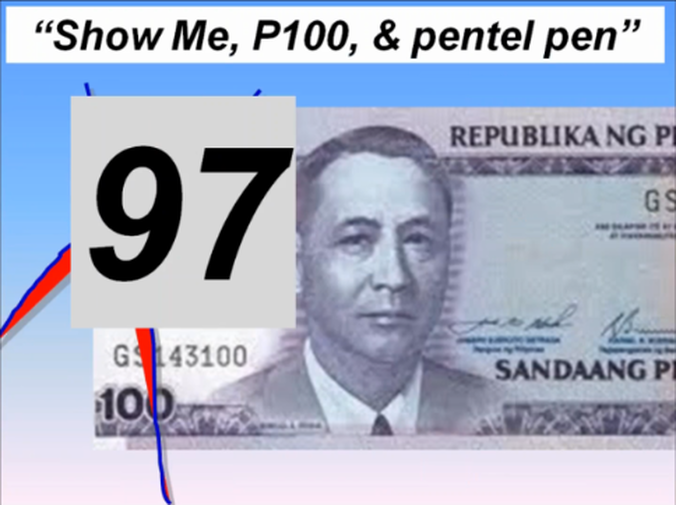

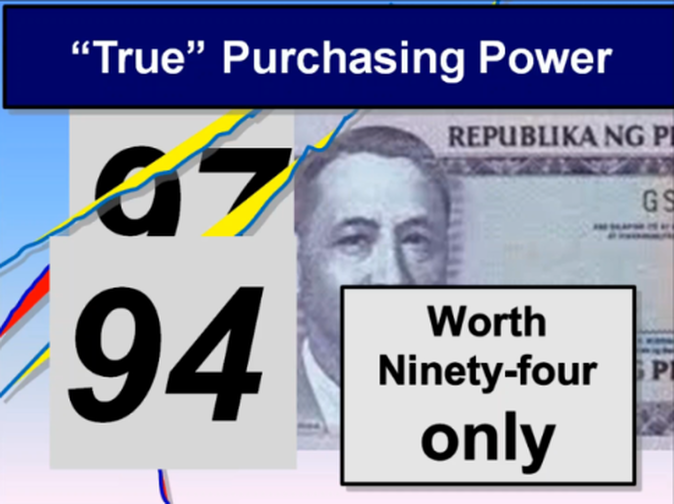

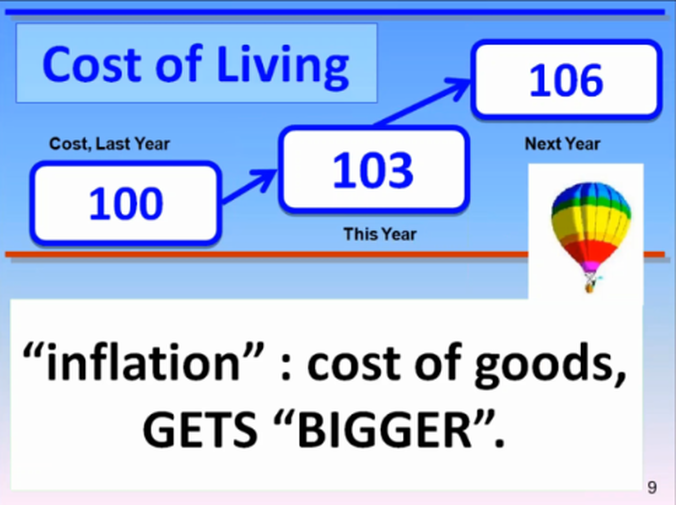

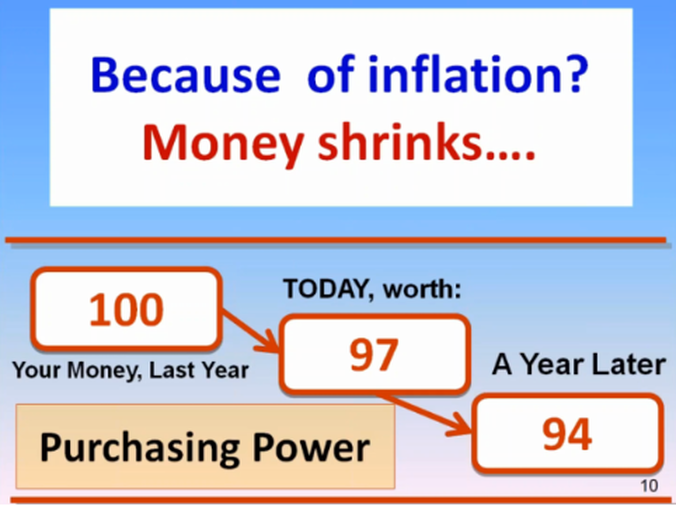

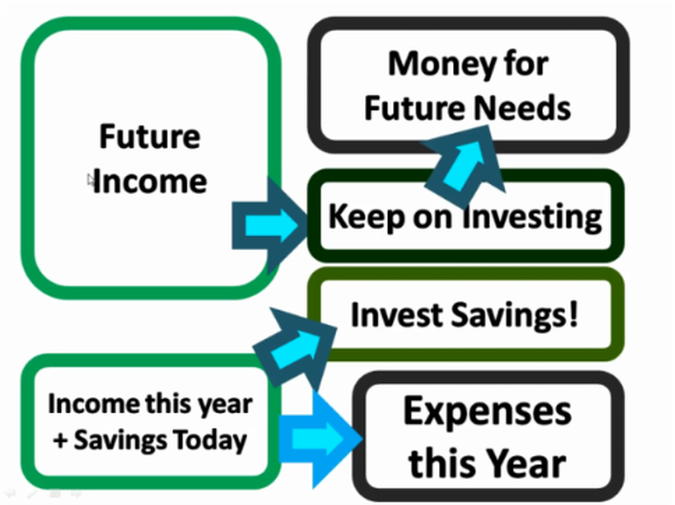

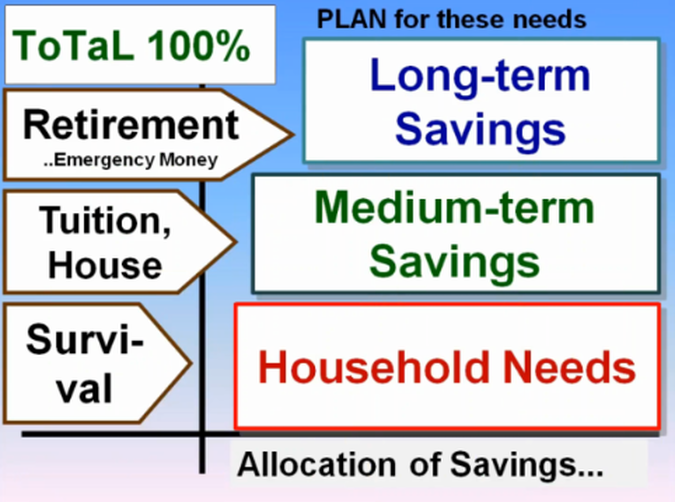

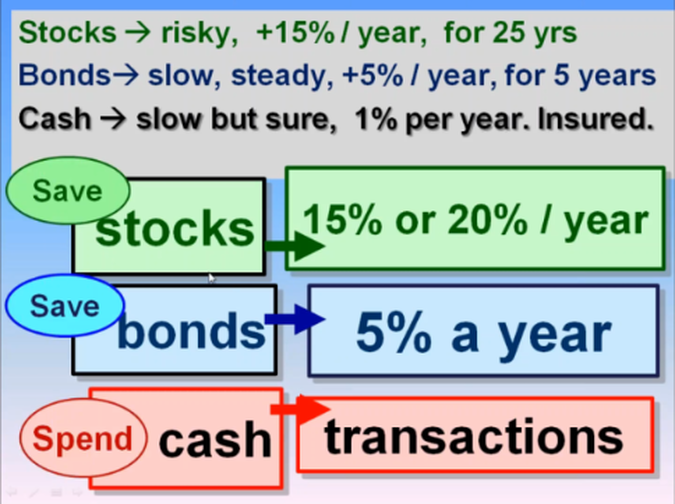

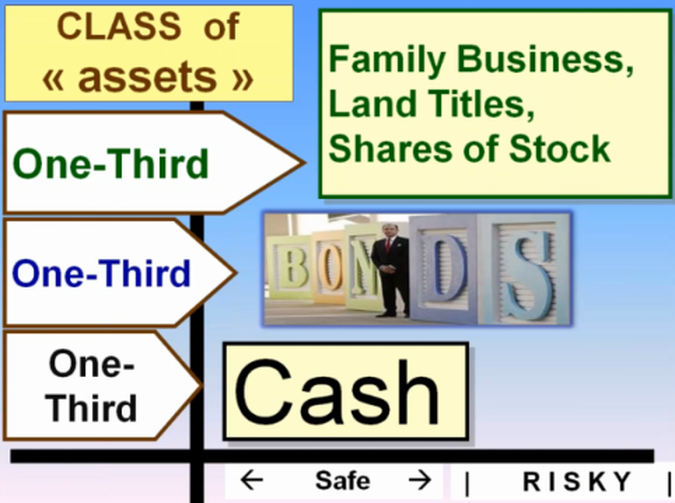

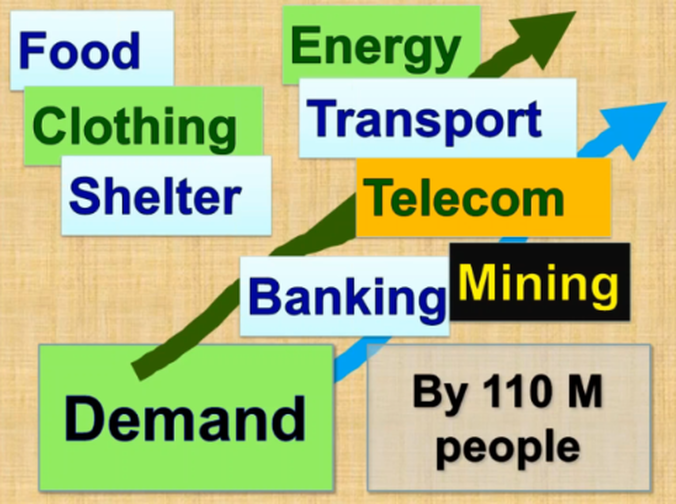

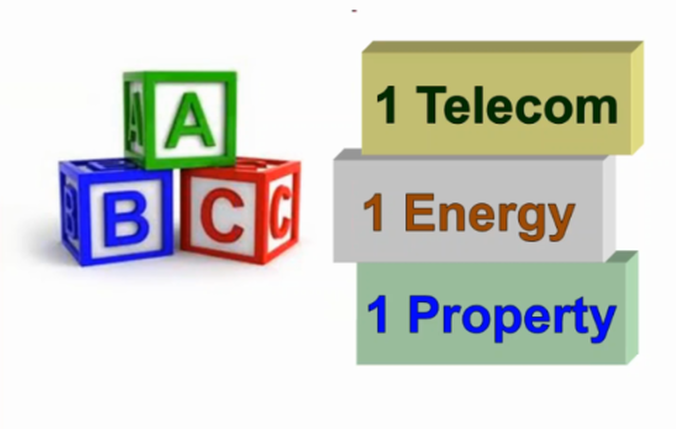

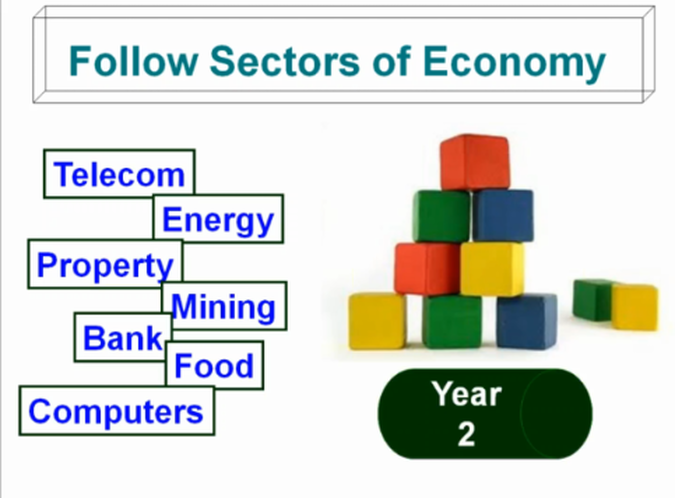

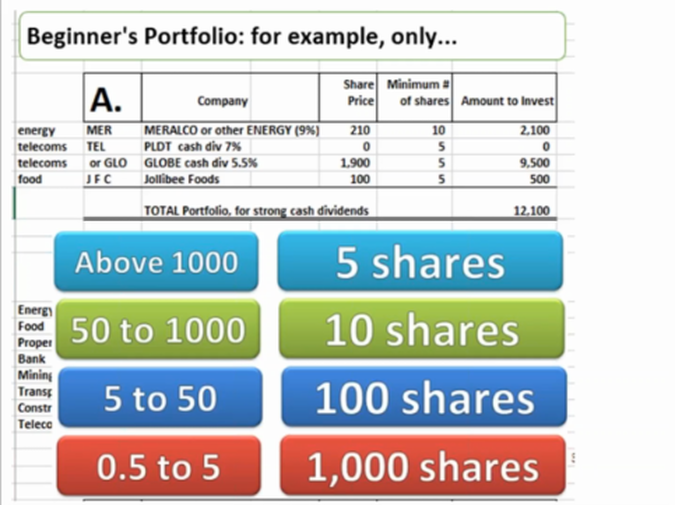

What is Portfolio Management? Choosing the Right Ingredients > Cook > Collection of Shares of Stock > Results = Health and Wealth Objectives of Portfolio Management Choosing the Right Investments > Assemble > Money grows 9% to 12% a year > Results = Retirement Money and Legacy Why is it necessary to Invest Money? Inflation > Counter-Act! > Your Money should also grow > Win over = Real Money Growth % Look at your Savings and Income Money for Household: Cash Money you need after some years: Bonds Money in case of emergency: Cash Money for Retirement and Legacy: Stocks How fast should your money grow? Future Needs > Faster Growth, over long-term Next Few Years > Slow but sure, via Bonds, 3-5% How fast can money grow? My Long-Term Investments = More than 7% Philippine Economy = 7% What is Economic Growth? GDP (Gross Domestic Product) 1980s = 0% 1990s = 2% 2000s = 4% 2010s = 6% 2020s = 8% How to build a Portfolio? Recap

2 Comments

|

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |