Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

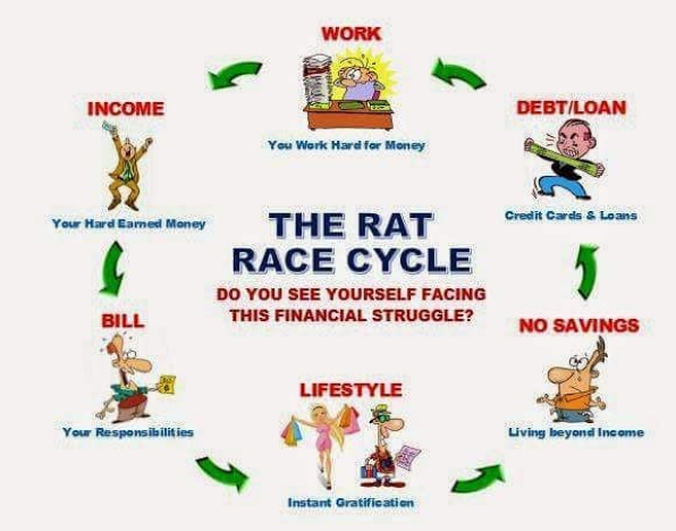

Do you see yourself facing this financial struggle? What Is A Rat Race? A Rat Race refers to the competitiveness between employees for upward mobility in the job market. It is analogous to rats in a wheel that compete against one another to be the first to get the reward—cheese. The rats continue to compete for this measly reward. When someone refers to the rat race idiom, someone envisions unhappy and harried people working long hours for little pay and little recognition. Yet, they continue to take part in the rat race because their families depend on their earnings. Robert Kiyosaki (Businessman and author of the well-known books Rich Dad Poor Dad & Cashflow Quadrant) describes the rat race idiom as a frustrating financial lifestyle. An employee works hard for an employer to receive pay, a salary increase, and a promotion. For some employees, as their income increases, their expenses or lifestyle increase as well. As the employee’s debt and lifestyle increase, he/she is tied to their job and more dependent upon their paycheck. They are forced to work harder for their next paycheck, salary increase, promotion to offset their debts and lifestyle. You're fulfilling your true purpose How To Escape The Rat Race? Change Your Mindset Mindset is Everything. Both poverty and riches are the offspring of your faith. Change your thoughts. You can't get rich thinking poor. Leave Behind Self-Limiting Beliefs Leave behind self-limiting beliefs that keep you stuck and start cultivating a powerful abundance mentality that attracts wealth naturally. Challenge your self-limiting beliefs. Most of them are not true at all. Surround yourself with strong, positive, motivated, and supportive people! Have Dreams Have you written down your dreams? Do you know why it is so powerful to write down your dreams? Dreams are ideas. They are abstract. You cannot see them. You cannot touch them. You cannot smell them. But the moment you write them down, they become tangible. You could see them. You could read them. Set Goals Ask yourself if what you are doing today is getting you closer to where you want to be tomorrow. People with goals succeed because they know where they're going. Make A Journal Are you doing what you truly want to do? Life Coaching helps people have their best lives. Everyone should have a form of a diary, journal, or planner. It's a great way to release your thoughts, dreams, goals, and ambitions in life. Invest In Yourself Attend seminars, webinars, listen to a podcast, and read good books about Personal Finance and Development. Reading a good book is like taking an adventure. It could change your life's perspective. Educating yourself about financial management is one of the most effective steps to get wealthy. But still, your money will always be your sole responsibility. You need to learn how to manage your finances accordingly. Set Financial Goals

You can't reach your goals if you don't set them. Planning how to use savings and investments to reach your goal is the key. Determine how much you need to save over time to finance your dreams. Include an emergency fund in your financial goals. Understand Where Your Money Is Going Create a budget that includes necessities, required expenditures, discretionary items, and the periodic savings necessary to finance long-term financial goals. Track your spending. Compare it regularly against your budget and make changes to your spending habits where necessary. Manage Your Debt A credit card is one of the most tempting portals towards bigger expenses. To launch effective personal finance, you must pay your bills first. Build a debt management strategy to reduce and eliminate high-interest debt and to accelerate the payment of debts. Maintain Steady Lifestyle Spending does not have to grow at the same rate as income. Growth in income, bonuses, and other windfalls can increase savings and investment accounts. Keeping expenditures relatively constant over time is a key method in achieving a secure financial future. Create More Income Streams (Invest Wisely) Your money is like a tree. If you save and invest, it will grow and have an extra income. But just like a tree, if you don't care about it, it will eventually wither and vanish. You can put your savings into an investment or emergency fund. Establish a low-cost, diversified portfolio that's appropriate to achieve both short-and long-term goals. Image Source: https://bit.ly/2X8cHeq

3 Comments

|

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |