Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

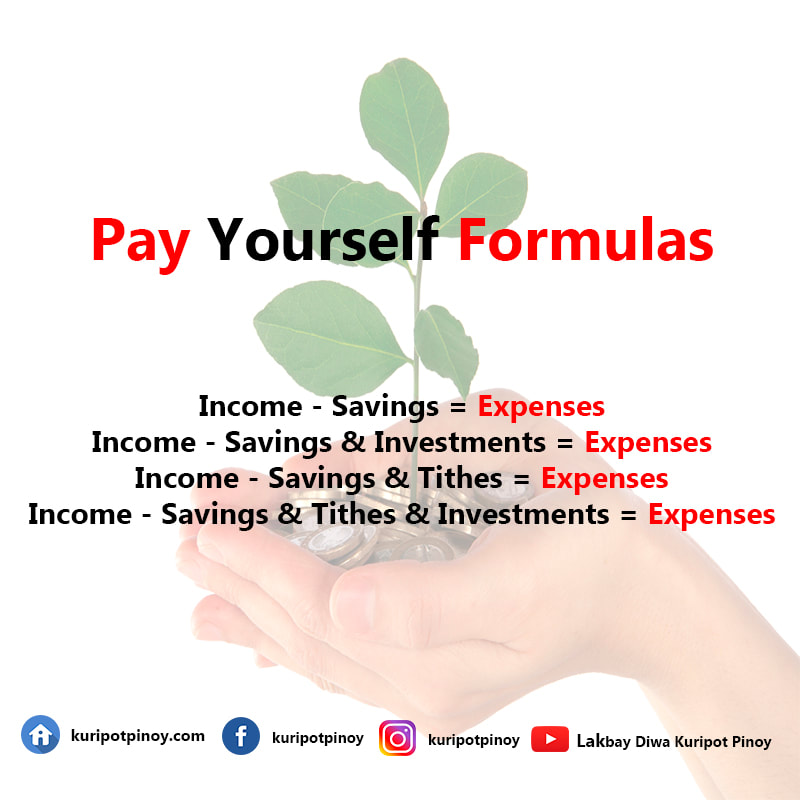

What should I do with my extra money? Money is hard to earn and easy to lose. Too many people spend the money they earn to buy things they don't want. Do not spend all your money buying things you don't need; know the difference between wants and needs. It is better to save some of your mid-year bonus for your future needs. So, where should you place your hard-earned money, then? Here are some of the investment options and ideas that you may consider for where to put your mid-year bonus. Pay Yourself First. Increase Your Emergency Funds The main purpose of an emergency fund is not an investment, it's protection with one purpose - to protect you and your family just in case there's an emergency. You should set aside 3-6 months' income to help cope with emergencies and unexpected changes. Protect Yourself and Your Family. Get Life Insurance. Getting life insurance will give you the maximum benefit in the future. If someone you love relies on your income, you need life insurance. Protect yourself and protect your loved ones. Share Your Blessings God blesses you so that you can bless others. Be a blessing! Pay Off Debt Control your debt or your debt will control you. A lot of people go into debt just to keep up with those who already are. Change your mindset about money. Save money and money will save you. Saving Account and Time Deposit Account Although the interest rate from a bank savings account is low, it is still better than keeping your money on a Jar or a Piggy Bank. Savings Account is good for an emergency fund or travel fund. You may also consider Time Deposit. It has a certain time frame also called maturity when you withdraw your money. You need to wait for the maturity period to earn the interest. Invest in Crowdfunding It is the practice of funding a project by raising monetary contributions from a large number of people. Invest in Bonds It is a debt investment in which an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period at a fixed interest rate. Invest in Pooled Funds Affordable investments, investing in a basket of securities, professionally managed and instantly diversified. You can choose where to invest your funds: Equity Funds, Bond Funds, Balanced Funds, and Money Market Funds. Invest in PERA (Personal Equity and Retirement Account) It is under Republic Act No. 9505. It refers to a voluntary retirement account established by and for the exclusive use and benefit of the contributor for the purpose of being invested solely in PERA investment products in the Philippines. Invest in Modified Pag-IBIG II (MP2) The MP2 program is solely a savings scheme, designed to provide Pag-IBIG I members with another savings option that would grant them a yield higher than those given under the Pag-IBIG I membership program. SSS P.E.S.O. Fund The SSS P.E.S.O. Fund (Personal Equity and Savings Option) is a voluntary provident fund offered exclusively to SSS members in addition to the Regular SSS program. Through this program, members who can contribute more are allowed to save more to receive higher benefits in the future. Invest in Exchange-Traded Funds (ETF)

It is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange. Invest in Stocks Stock is a type of security that signifies share/ownership in a corporation. You can make money in stocks by "Price Appreciation and Dividends." Start a Side Business or Online Business You can start a side business or an online business to make some extra money for you and your family. There are lots of business ideas that require little or no capital.

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |