Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

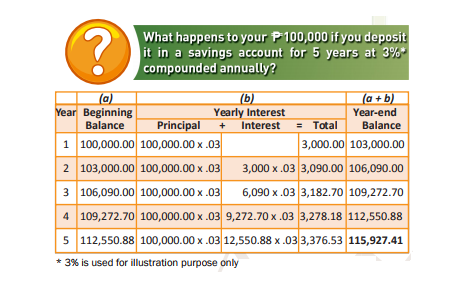

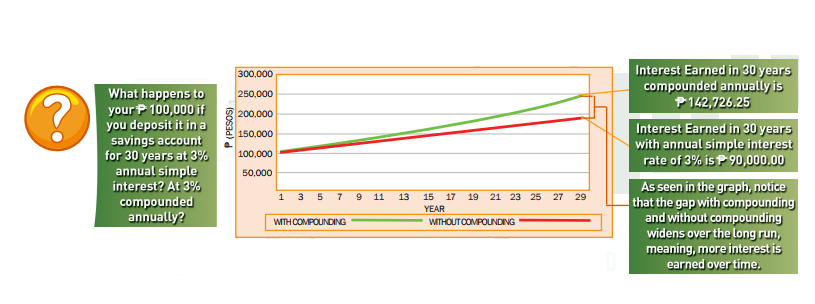

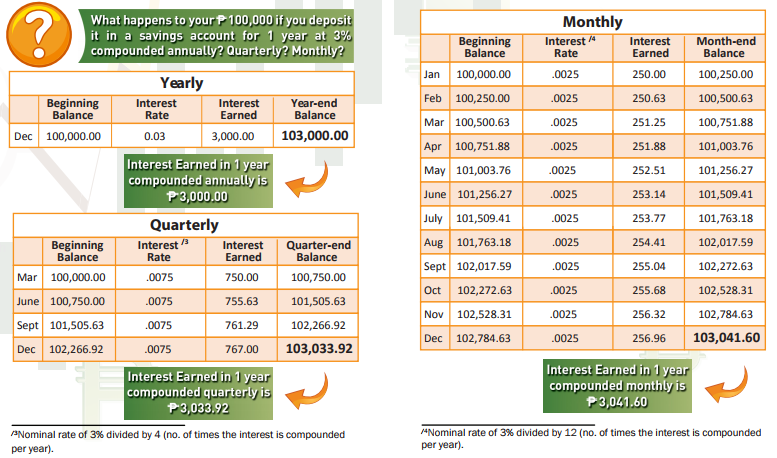

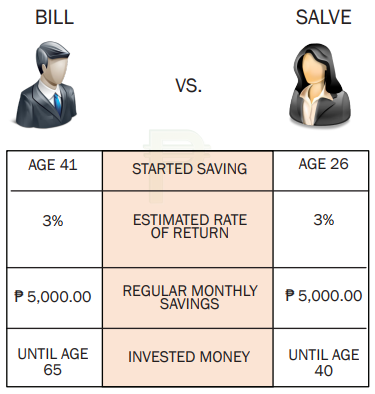

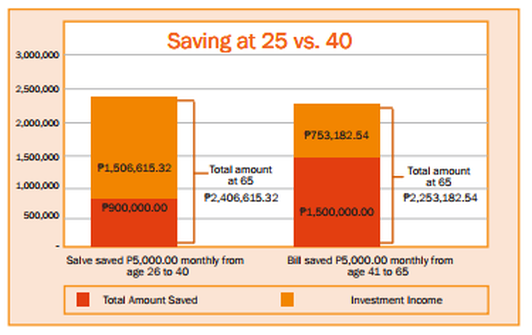

For a wise saver, compound interest can be used to make a significant sum of money over time. The Power Of Compounding Albert Einstein once said, “compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't... pays it." What Is Compound Interest? Compound Interest is the interest calculated on the sum of the principal of a deposit and the interest it earned. Thus, it is an interest on interest. This is illustrated in the following example: With interest compounded annually, you will earn Php 15,927.41. However, without compounding, the total interest you earn will only be Php 15,000.00. You can earn compounded interest in deposit and investment products such as savings, time and zero coupon bond. Compounding will also apply to other investments like stocks and mutual funds if you reinvest your earnings to other investments. The formula calculating compound interest is: S=P(1+r/n)nt where S is the value after the specified time, P is the principal amount, r is the nominal rate, n is the number of times the interest is compounded per year and t is the number of years the money is saved/borrowed. The formula for simple interest is: Simple Interest = Principal x Rate x Time. Thus, the interest earned without compounding is:Php 100,000 x .03 x 5yrs.= Php 15,000. With Compounding Vs. Without Compounding Compounding works best when you allow your money to grow over a longer period of time. To demonstrate, let’s look at another example. Advantage Of Frequent Compounding The more frequent the compounding, the greater the impact. How Can You Benefit From The Power Of Compounding? You can make compounding work for you by: Saving As Early As You Can Compounding works best for you when you let your savings or investment grow over a longer time horizon. Therefore, the earlier you start, the longer compounding can work for your money. Here is an example for saving early vs. saving later: By the time they are both ready to retire at age 65, Salve has Php 2,406,615.32 and Bill has Php 2,253,182.54. Although Salve invested only Php 900,000.00 in total compared to Php 1,500,000.00 by Bill, Salve ended up with more money than Bill because of the power of compounding. Saving Regularly Compounding is more powerful if you make the habit of saving and investing regularly. Here is the comparison of Saving Early vs. Saving Later The act of saving and investing money regularly will significantly change the way you live your life in the future.

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |