Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

Is Peso Cost Averaging a good investment strategy? With the market's volatility, no one can know for sure when is the right moment to buy or sell. There is, however, a time-tested approach that can take the guesswork out of market timing, called Peso Cost Averaging. What is a Peso-Cost Averaging or PCA? Peso-Cost Averaging is an investment technique or strategy where you regularly buy investments regardless of its current price and market condition. Putting a set amount of money regularly into an investment such as stock or mutual fund. More shares are purchased when prices are low, and fewer share are purchased when prices are high. The cost of share over time eventually averages out. Pros

Cons

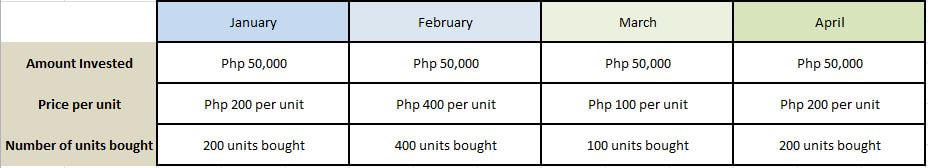

How does it work? For example you have an extra money worth Php 200,000 and want to invest it. You can split it into equal portions and invest every month regardless of the price. Remember: More units are bought when the prices are low. Fewer units are bought when the prices are high.

But why not just invest everything in one go? Are prices high or are prices low? Nobody really seems to know. If you keep on waiting for prices to fall, you may end up not investing at all! Again, things to remember when doing PCA:

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |