Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

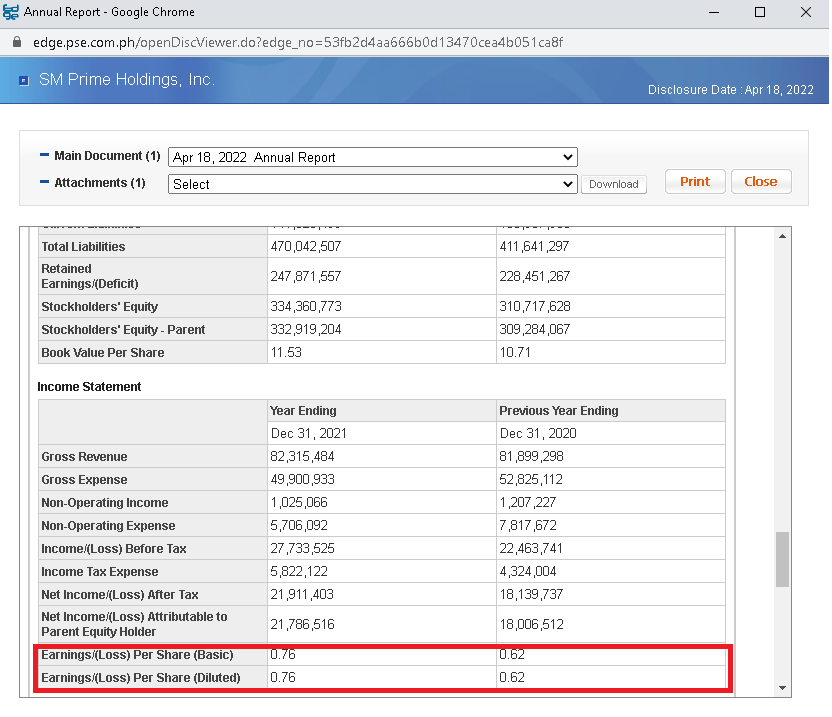

What is the Price to Earnings Ratio? How does the P/E Ratio work? What is P/E Ratio? P/E Ratio, also commonly referred to stands for the Price to Earnings Ratio of a company. It is a valuation ratio of a company's current share price to its per share earnings. This is the most popular metric of stock analysis, though not the only one. What is the formula for P/E Ratio? P/E Ratio = Market share price/Annual Earnings Per Share (EPS) The market share price is the current market price of a single share. The annual earnings per share (EPS) is the net income of the company for the most recent 12 months period divided by number of outstanding shares of the company. If you are an investor in the Philippine Stock Exchange, you can see the EPS in the disclosures of each listed company. Just visit edge.pse.com.ph for company announcements and disclosure.

Some thumb rules: Some investors read a high P/E as an over-priced stock, which may be the case sometimes. However, it can also indicate that the market has high hopes for the share's future and has bid up the price. Why is P/E Ratio very important for investors? It helps investors analyze how much they should pay for a stock based on its current earnings and also shows if the market is overvaluing or undervaluing the company. In simple terms, it helps the investors to tell if a certain stock is cheap or expensive by comparing its price with its earnings.

Why Low P/E Ratio? A Low P/E Ratio may indicate vote of no-confidence by the market which means that the investors have undervalued the stock due to lack of confidence in its future growth. However, it could also mean that this is a stock which has been overlooked by the market and does possess strong future growth potential. If this is the case, they are considered value stocks and investors sometimes make their fortunes spotting these golds before the rest of the market discovers their true value. So what is the right P/E Ratio? There's no correct answer to this question because part of the answer depends on the investor's willingness to pay for earnings. The more the investor is willing to pay high P/E means that he/she believes that the company has good long-term prospects over and above its current position. So, for some investors, a P/E ratio of something, let's say 20 would be a great deal while for some others a P/E of 20 for a particular is high. So, a P/E ratio also depicts the perceived value of a particular stock. What are the factors affecting P/E Ratio? Here are some factors that affects the P/E Ratio of a particular company. Growth Better the growth prospects of the company, the more willing people are to be part of that company. Risk The higher the risk, the lesser inclination people would have; to invest in equity shares thus affecting share price to an extent. Past Track Record Track record is a major factor that determines consumer trust and willingness to invest in a particular company. Government Vision Government's approach and vision for a particular industry and company affects the P/E Ratio. Government restrictions on certain industries affects business of a company and hence its share price. Performance of the Economy A higher productivity, and growth in economy will reflect on the stock's P/E Ratio. What happens to the Price to Earnings Ratios if only: The Stock price goes higher? The P/E Ratio goes higher. The Stock price goes lower? The P/E Ratio goes lower. The Earnings go higher? The P/E Ratio goes lower. The Earnings go lower? The P/E Ratio goes higher. Who uses P/E Ratio? P/E Ratio is best used for stocks that can compound investors' wealth.

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |