Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

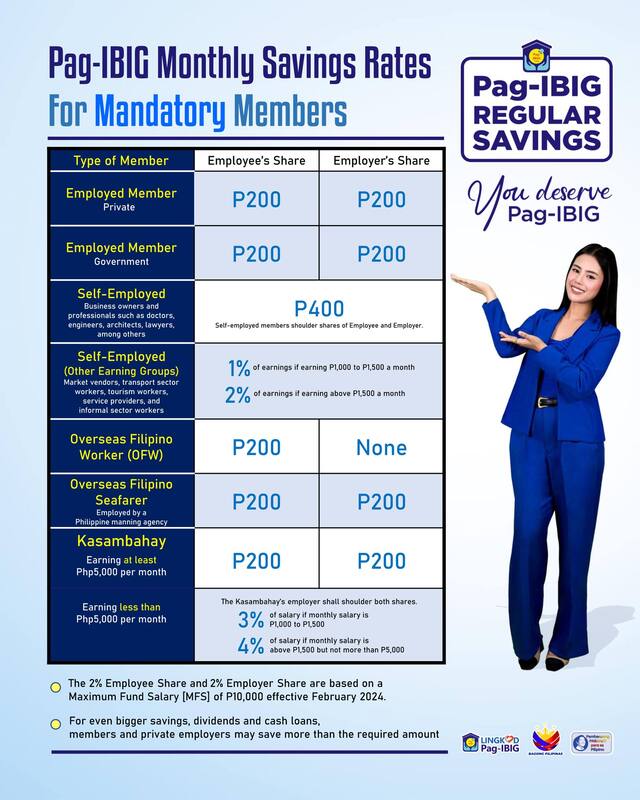

Pag-IBIG Fund: New rates will be Implemented Starting February 2024; Members will Gain More Benefits1/17/2024 Pag-IBIG Fund members are set to enjoy doubled savings and higher cash loan entitlements while continuing to have access to affordable home loans, as the agency is set to increase the nearly four-decade old mandatory monthly savings for both members and their employers starting February 2024, officials announced Wednesday (17 January). Under the agency’s new rates, the monthly savings of Pag-IBIG Fund members for both the employee’s share and the employer’s counterpart shall increase to P200 each from the current P100. This follows the adjustment in the maximum monthly compensation to be used in computing the required 2% employee savings and 2% employer share for Pag-IBIG Fund members, which shall now increase to P10,000 from the current P5,000. “We at Pag-IBIG Fund have long recognized the need of our members to have higher savings that shall provide them with decent and fair returns upon their retirement, as well as higher cash loans to help them during times of need. By implementing the new Pag-IBIG Monthly Savings Rates of both members and employers originally scheduled in 2021, not only would we be able to improve the benefits of our members, we would also be better equipped to finance the growing demand for home loans of our members while maintaining our affordable rates. All these are in line with the call of President Ferdinand Marcos, Jr. to provide Filipino workers with opportunities to gain comfortable and productive lives,” said Secretary Jose Rizalino L. Acuzar, who heads the Department of Human Settlements and Urban Development (DHSUD) and the 11-member Pag-IBIG Fund Board of Trustees. Pag-IBIG Fund’s new monthly rates were initially approved by its Board of Trustees in 2019, after obtaining the concurrence of stakeholders to implement a scheduled increase in 2021. During that time, the agency saw the increase necessary as it projected that the amount of loans disbursed will eventually outpace the total collections from both loan payments and members’ savings. However, due to the difficulties brought about by the COVID-19 pandemic in 2021 and 2022, the Pag-IBIG Fund Board deferred the increase of the agency’s savings rates. The agency again deferred the implementation of the increase in 2023, following the request of the Employers’ Confederation of the Philippines to provide the business community with time to further recover from the continuing financial challenges due to the health crisis. The deferment was also the Pag-IBIG Fund’s response to the call of President Ferdinand Marcos, Jr. early last year, to alleviate the financial burden of fellow Filipinos due to the prevailing socio-economic challenges brought about by the COVID-19 pandemic. Pag-IBIG Fund Chief Executive Officer Marilene C. Acosta, meanwhile, expressed her appreciation for the support of stakeholders, and assured members of better benefits under the agency’s new rates. “We thank the Trade Union Congress of the Philippines (TUCP), the Federation of Free Workers (FFW), the Philippine Government Employees’ Association (PGEA), Overseas Filipino Workers’ (OFW) organizations, and the Employers’ Confederation of the Philippines (ECOP) for supporting our plans and for recognizing that raising our monthly savings rates will allow Pag-IBIG Fund to continue to provide affordable home loans to its members in the coming years,” Acosta said. “It is also important to note that the increase in our monthly savings rates shall benefit our members the most because every peso they save will go to their Pag-IBIG Savings. Under our new rates, they will have higher Pag-IBIG Savings that earn annual dividends, which they shall receive upon membership maturity or retirement. For example, based on our old rates, a member would receive around P87,000 upon reaching membership maturity. On the other hand, a member who saves under our new rates over a period of 20 years would receive P174,000 or double the amount. And, because of their higher savings, they shall also be entitled to higher multi-purpose and calamity loan amounts to help them with their financial needs,” Acosta emphasized. How much is the new monthly contribution to Pag-IBIG in 2024? With Pag-IBIG's new savings rate in effect this February, see the table below to know your contribution based on the type of your membership. Remember, your Pag-IBIG monthly savings earn dividends and will be given back to you upon maturity as your "lump sum!" The bigger your savings, the bigger the cash loan you can get! Pag-IBIG savings doubled along with the growth of Pag-IBIG MPL! Borrow up to 80% of your doubled Pag-IBIG savings when you want extra cash.

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |