Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

Send and receive money instantly, anywhere you may be with Instapay.

What is Instapay?

InstaPay is an electronic fund transfer (EFT) service that permits customers to transfer PhP funds almost instantly between accounts of participating BSP-supervised banks and non-bank e-money issuers within the Philippines. It's available 24x7, all year round. Who can use Instapay? Customers of InstaPay participating institutions with savings, current, or e-money accounts (with or without ATM/debit cards) can use InstaPay for sending and/or receiving fund transfers. Users of Instapay could also be individuals, businesses, or government agencies.

Why would one use Instapay?

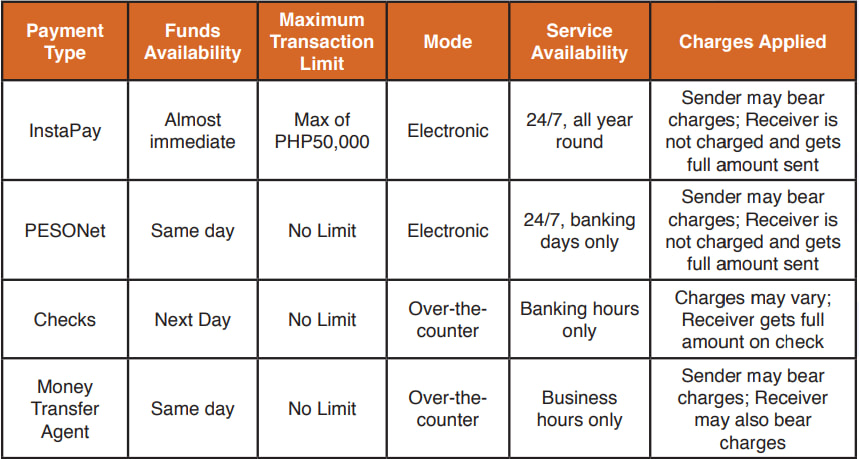

Transfer funds electronically and make the funds to be available to their recipient immediately. How to use Instapay? To send funds via InstaPay, customers got to access their bank’s or e-money issuer’s mobile app or internet banking facility, prefer to send to a different institution via InstaPay, and provide the specified information. Some participating institutions provide a transaction receipt to notify the sender that the transfer is successful. At the minimum, the sender must identify the bank or non-bank e-money issuer where the receiving account is maintained, the account number of the receiver, and therefore the amount to be transferred. To receive funds via InstaPay, customers don’t need to do anything but they can verify if their account has been credited with the funds transferred by accessing their bank’s or non-bank e-money issuer’s mobile app or internet banking facility. Some participating institutions provide SMS or email notification upon receipt of funds. What are the minimum and maximum transaction limits for using Instapay? Customers can transfer funds up to PhP 50,000 per transaction repeatedly during the day. They ought to, however, contact their bank or non-bank e-money issuer to verify if there's a minimum amount for sending via Instapay or a daily limit on the aggregate amount a customer may transact in a day. Are there charges for using Instapay? Participating institutions may apply a fee for sending via InstaPay. The fee may vary counting on each participating institution’s pricing strategy. there's no fee, however, for receiving funds via InstaPay. Customers receive the amount in full. How does Instapay compare to other methods? Are transfers via Instapay secure? BSFIs offering InstaPay are required to follow minimum security standards mandated by the Bangko Sentral ng Pilipinas. Can Instapay be used to transfer funds to an account overseas? InstaPay is only available for PhP fund transfers between accounts maintained in the Philippines with InstaPay participating institutions. Can Instapay be used to transfer funds from an Instapay participating institution to a non-participating institution? InstaPay can only be used to transfer between accounts maintained with InstaPay participating institutions. How are erroneous fund transfers handled? As with other funds transfer services, customers sending via InstaPay must exercise due care in providing the correct recipient’s information and amount to be transferred. Customers should check the information carefully before allowing the transaction to proceed. Funds transferred via InstaPay are credited almost immediately and with finality. If a customer transferred funds to the wrong beneficiary account, the customer should inform their bank or non-bank e-money issuer as soon as possible. On the other hand, if a customer received money and does not know where it came from, the customer should call their bank or non-bank e-money issuer immediately and authorize it to return the money to the sender.

What if a customer has a complaint about Instapay?

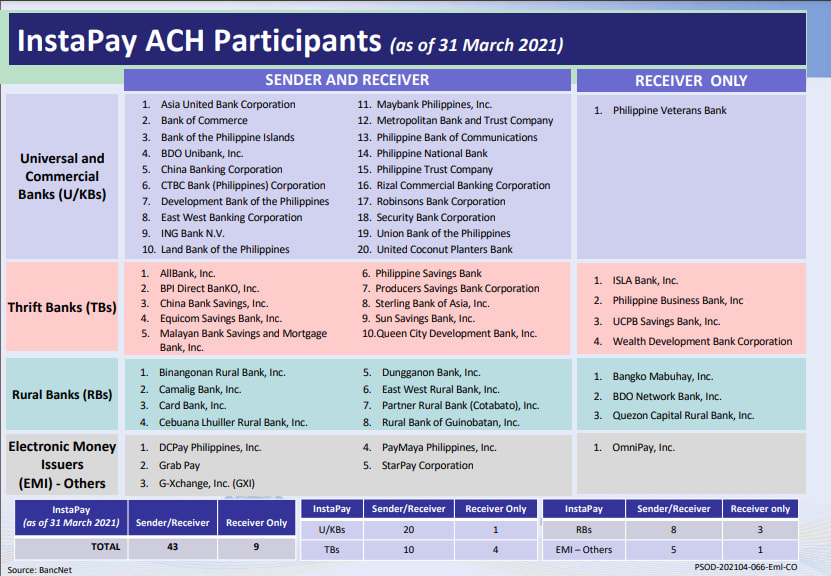

For complaints and other requests, customers may contact the customer service hotline of the participating institution where they maintain their accounts. For complaints left unattended/not sufficiently addressed by participating institutions, account holder/s may also contact the Consumer Empowerment Group of the BSP. What Governing Body overseas Instapay? InstaPay is governed by an industry-led body known as the Philippine Payment Management Inc. under the oversight of the Bangko Sentral ng Pilipinas. How does Instapay operate? The rules and service levels that govern InstaPay are defined, agreed upon, and observed by the ACH participants. Settlement is done via the BSP’s real-time gross settlement system, known as PhilPaSS. The settlement of all net clearing obligations are required to be prefunded through the participant institution’s DDAs maintained with the BSP. This significantly mitigates credit risk and opens equal opportunities to small and large institutions to participate in the Instapay ACH. InstaPay participating institutions that do not have PhilPaSS membership may participate through a sponsorship arrangement with a PhilPaSS member. Which are the Instapay participating institutions?

For more information on InstaPay, you may visit BSP Website.

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |