Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

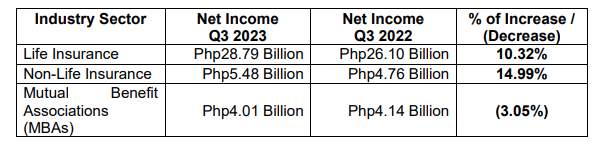

According to the Insurance Commission, the net income of life and non-life insurance companies and mutual benefit associations (MBAs) increased by 9.38% year-on-year during the 3rd quarter of 2023. Based on latest data from the Insurance Commission, the insurance industry registered a net income of Php38.28 billion as of the end of the 3rd quarter of 2023. This is a 9.38% increase from the industry’s net income of only Php35 billion for the same period in 2022. Both life and non-life insurance companies registered high net income growth rates for the 3rd quarter, as shown in the following table: As shown in the table above, net income of the life insurance industry increased by 10.32% to Php28.79 billion. Net income of the non-life insurance industry also grew by almost 15% to Php5.48 billion.

Mutual benefit associations (MBAs), however, experienced a slight decline of 3.05% in net income year-on-year, due to a significant increase in Total Underwriting Expenses of Php9.64 billion as of the 3rd quarter of 2023, which is 32.72% higher than figures during the same period last year. The increase in net income of the insurance industry could be attributed to the increase in premium collection by both life and non-life insurance companies. As of the 3rd quarter of 2023, life insurance companies have already collected total premiums of Php229.89 billion. A total of Php46.57 billion thereof is considered as new business, which is a growth of 13.93 percent from figures for the same period last year. Non-life insurance companies registered total net premiums written of Php48.21 billion as of the said period, which is 15.56% higher than total net premiums registered during the same period last year. Even MBAs registered higher total contributions of Php11,494.4 billion, which is 7.43% higher than figures during the same period last year. Data for the 3rd quarter of 2023 also indicated the insurance industry’s continued growth in terms of assets, invested assets and net worth. Total assets and net worth grew by almost 10% year-on-year, while total invested assets increased by almost 15%, as shown in the following table:

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |