Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

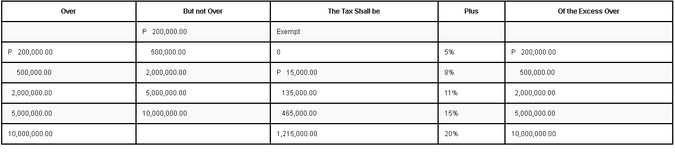

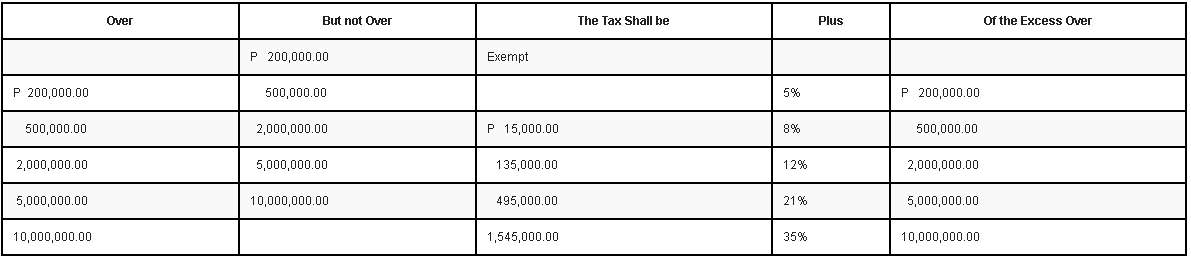

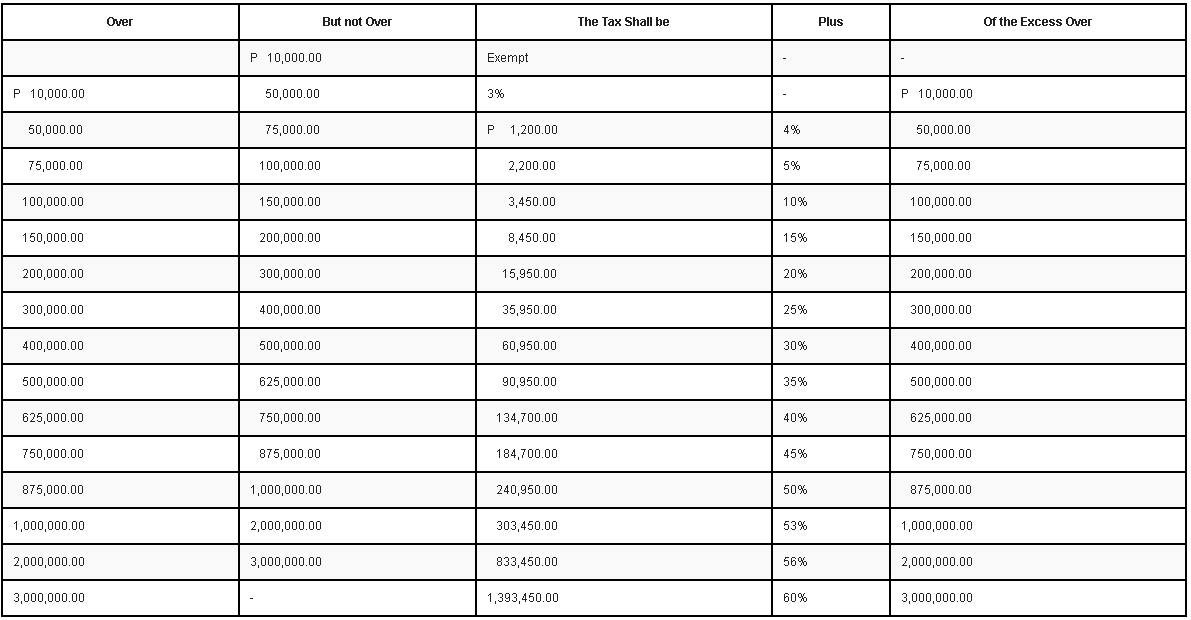

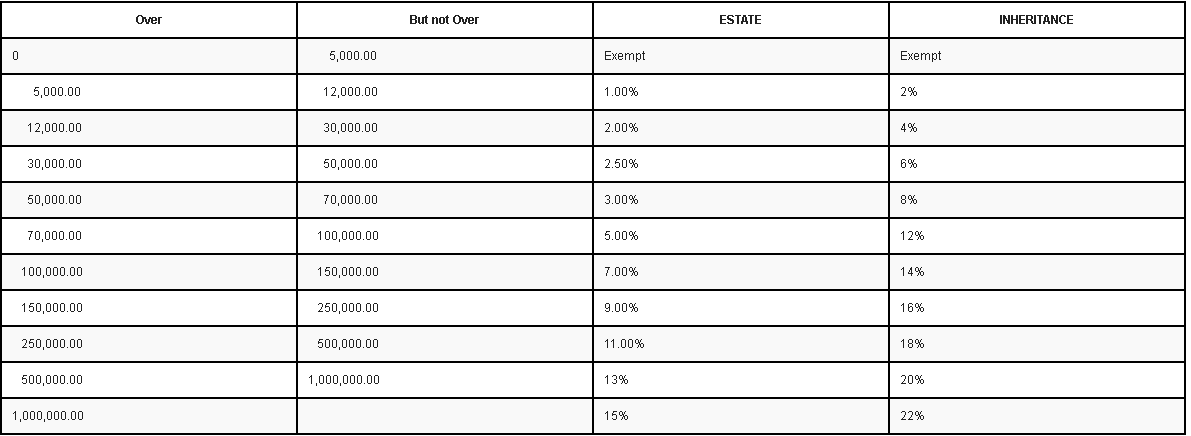

Benjamin Franklin once said, "By failing to prepare, you are preparing to fail." An Estate is the net worth of a person at any point in time alive or dead. Your Real Estate, Investments, Savings Accounts, Personal Property and Business Interests. On the other hand, as described by the Bureau of Internal Revenue (BIR), Estate Tax is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are made by law as equivalent to testamentary disposition. It is not a property tax. It is a tax imposed on the privilege of transmitting property upon the death of the owner. The Estate Tax is based on the laws in force at the time of death notwithstanding the postponement of the actual possession or enjoyment of the estate by the beneficiary. An estate tax is calculated by first determining the value of the deceased’s net estate or net value. Gross Estate/Value – Allowed Deductions = Net Estate x 6% (*Estate Tax Rate) = Estate Due *Republic Act No. 10963 (TRAIN Law) The value of the gross estate of the decedent shall be determined by including the value, at the time of death, of all property, real or personal, tangible or intangible, wherever situated. However, that in the case of a nonresident decedent who, at the time of death, was not a citizen of the Republic of the Philippines, only that part of the entire gross estate which is situated in the Philippines shall be included in the taxable estate. In layman's terms, it is the tax paid to transfer your cash, bank accounts, investments, collectible items, personal possessions, and real property to your family or beneficiary. Estate Tax 101 Here's the table Tax Rates from the Bureau of Internal Revenue (BIR) Effective January 1, 2018 to present [Republic Act (RA) No. 10963] There shall be an imposed rate of six percent (6%) based on the value of such NET ESTATE determined as of the time of death of decedent composed of all properties, real or personal, tangible or intangible less allowable deductions. Effective January 1, 1998 up to December 31, 2017 (RA No. 8424) If the Net Estate is For Example: Based on the table, if the net value of the estate of someone who died does not exceed Php 200,000.00 then the beneficiaries are exempted to pay the estate tax. Another Example: If the net value of the estate to be inherited is valued at Php 1,000,000.00, the estate tax shall be Php 15,000.00 plus Php 40,000.00 (or eight percent of Php 500,000), which totals Php 55,000.00. Php 500,000.00 x 8% = Php 40,000.00 Total Estate Tax = Php 15,000.00 + Php 40,000.00 = Php 55,000.00 Effective July 28, 1992 up to December 31, 1997 (Section 77 of the NIRC, as amended (RA No. 7499) If the Net Estate is Effective January 1, 1973 to July 27, 1992 (Section 85 of the NIRC, as amended (Presidential Decree No. 69) If the Net Estate is Effective September 15, 1950 to December 31, 1972 (Section 85 of the NIRC, as amended (RA No. 579) Estate and Inheritance Tax If the Net Estate is Effective July 1, 1939 to September 14, 1950 (Section 85 of the NIRC, as amended (Commonwealth Act No. 466)

Estate and Inheritance Tax If the Net Estate is

20 Comments

Cherie

6/28/2019 10:00:39 am

How do we calculate the estate tax of a real estate property when there has been 5 that has been dead in the family and the title was not passed on to the heirs and is still in the name of the grandparents. Like, title is under the name of grandpa and grandma. They have 3 children, now all dead. Their children have heirs now wanting to sell the land. How do we calculate then? Is it based on each death? I hope to hear from you soon. Ty.

Reply

Efren G. Goli Cruz

7/27/2019 01:35:12 am

If the title of the property is still in the name of the grandparents of the surviving heirs, then surviving heirs or the grandchildren have to execute an Extra-Judicial Settlement. The Estate Tax Amnesty is valid until June 14, 2021, therefore the heirs have enough time to prepare all the documents needed in order to file and pay the Estate Tax. Note that for every stage of transfer the estate tax will have to be paid i.e. if the grandmother died first then 50% of the estate is subject to estate tax. And when the grandfather died the basis is 50% of the total estate + 1/4 of the 50% of the estate. When the children of the grandparents died, each child's basis of the estate tax is 1/3 of the total estate of the grandparents of the surviving heirs. Once the documentary requirements are complete then what you need to do is visit the ONETT of the RDO where the last resident's address of the grandparents is located.

Reply

Yumie

7/25/2019 09:17:27 pm

Hi,

Reply

Hi Yumie,

Reply

Nelly

7/29/2019 06:46:02 pm

Hi Rap!

Reply

Hi Nelly,

Reply

Ronald

8/15/2019 12:03:08 am

Kung ang lolo ko po ay namatay noong 1990, at may lupa siya na 116sqm na nagkakahalaga ng 9,600/sqm that time, ito po ba ang pagbabasihan para ma compute ang estate tax, kung babayaran ito ngayon?

Reply

Hi Ronald,

Reply

Ena

10/8/2019 08:50:01 pm

Hi ask ko lang po if father passed away and there are 3 children how is the tax charged is it 6% each of the heirs? In your example the total net estate tax is p55,000, so if the property will be transferred to all them equally are they going to pay p55,000 total or p55,000 each?

Reply

Hi Ena!

Reply

Rodrigo Leonardo

10/10/2020 09:04:35 pm

if I am going to file for a tax amnesty and both name of my parents appears on the title.am I going to file a separate computation as they both died separately?

Reply

Philip

12/15/2020 06:06:08 am

Hello, if a decedent is a co owner of a real property that has not been subdivided amongst the co-owners and with a value of P10million (decedent owns 10% on the real property), how will the value of his estate be calculated? And how will the estate tax be calculated? Thanks.

Reply

What will be used as the basis in the valuation of property?

Reply

Raphael Marcial

4/17/2021 09:32:26 am

Hi Rap,

Reply

Michael

12/28/2021 09:43:39 pm

Grandparents died with 6 heirs, 3 have died with children. 360 sq meters total land valued at 6M at time of death. Each heir gets 60 sq meters or 1M each. EJS completed for the estate of the grandparents. So, we pay 6% of 6M minus deductions. Done. But, isn't there another stage because there are deceased heirs? 3 are deceased, so that are three estates, right? Does each have to pay 6% of 1M? Thank you.

Reply

arthur

10/11/2023 01:00:14 am

ano ba un dst na ksama sa estate na sa examiner daw ,na babayaran k daw ng 4000

Reply

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |