Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

Why should active traders use FirstMetroSec PRO? First Metro Securities Brokerage Corporation is a stock brokerage house licensed to trade in the Philippine Stock Exchange. They are the market maker and one of the authorized participants of the country’s first and only Exchange-Traded Fund (ETF), the First Metro Philippine Equity Exchange Traded Fund (FMETF), which tracks the performance of the PSE Index. First Metro Investment Corporation is the investment banking arm of the Metrobank Group. Metrobank Group has launched the most advanced online stock trading platform in the Philippines, FirstMetroSec Pro. What is FirstMetroSec PRO? FirstMetroSec PRO is by far the most advanced online stock trading platform available for the Philippine Stock Market. The new Internet-based system is designed for active traders who need fast access to the most relevant trading information. PRO introduces features that were previously only available to industry professionals, that enable closer market monitoring, faster trading, and better portfolio management. Is PRO available to all FirstMetroSec clients? Access to PRO is exclusive to clients who meet minimum requirements. What requirements are needed to gain access to PRO? PRO is available to clients who trade at least Php 100,000 in accumulated value per month, or maintain a mutual fund or stock portfolio of at least Php 200,000. Once qualified, how long will it take to activate my PRO access? According to First Metro Securities, batch activation of PRO accounts is done every Wednesday. You will be notified via email on your registered e-mail address. Is there a way to check if I am eligible for PRO? Yes, send an e-mail and include your online trading account code (OTA code) and Account Name to [email protected]. Do I need a FirstMetroSec Account to gain access to PRO? Yes, to be eligible for PRO, you should be an existing client of FirstMetroSec. Is there an expiration date on my PRO access? PRO access is valid for one (1) month unless stated otherwise. Can I withdraw my funds through PRO? As per First Metro Securities, you can withdraw your funds through PRO. Can I log in to the classic site and PRO at the same time? You can only log in and use either of one of the two trading platforms at a time. Are there fees for using the PRO platform? PRO access is free of any fees for eligible clients. I currently cannot meet your existing criteria, is there a subscription plan for PRO? As per First Metro Securities, they are currently working on PRO’s pricing model. Is there a mobile app for PRO? As per First Metro Securities, they are currently developing a new app for PRO. Are there only hours to access PRO? Access to PRO is available 24/7, anytime, anywhere. PRO CRITERIA:

Some of the new benefits or features of FirstMetroSec PRO Overall User Interface

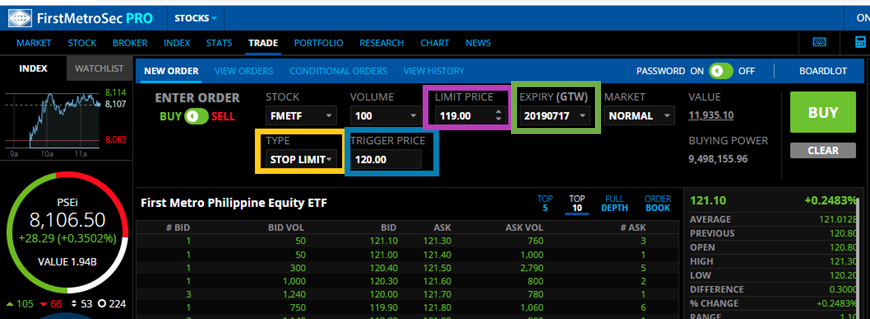

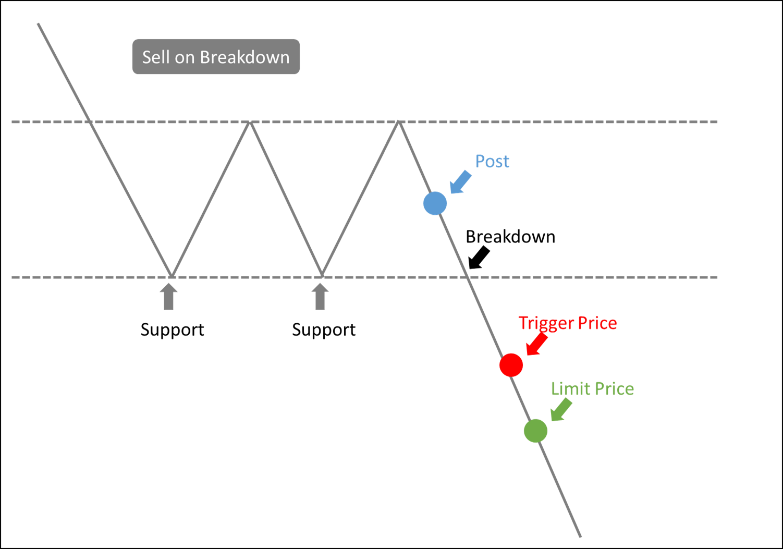

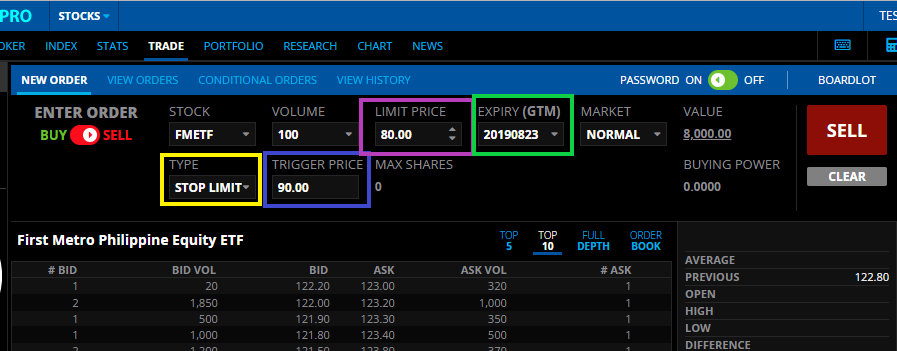

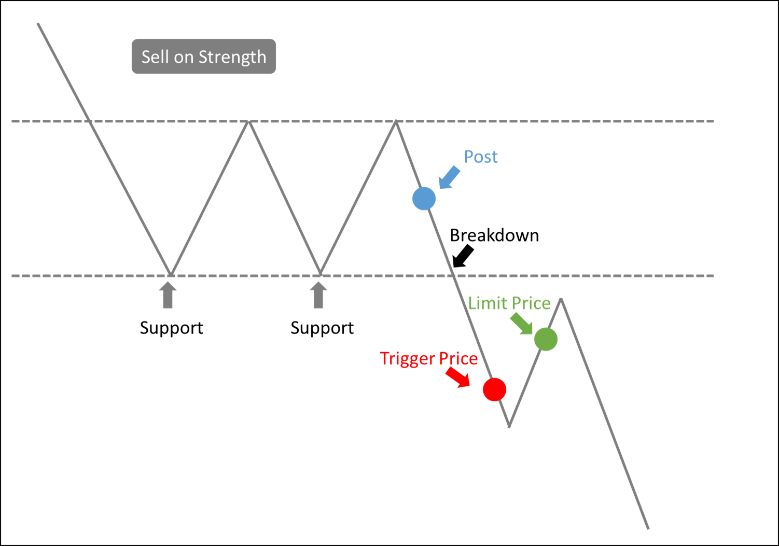

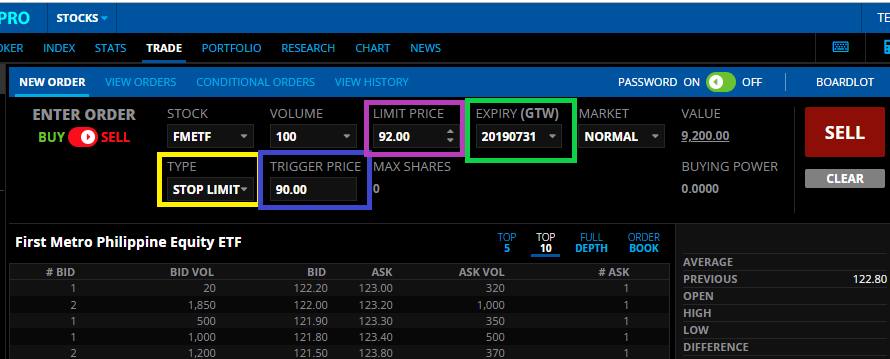

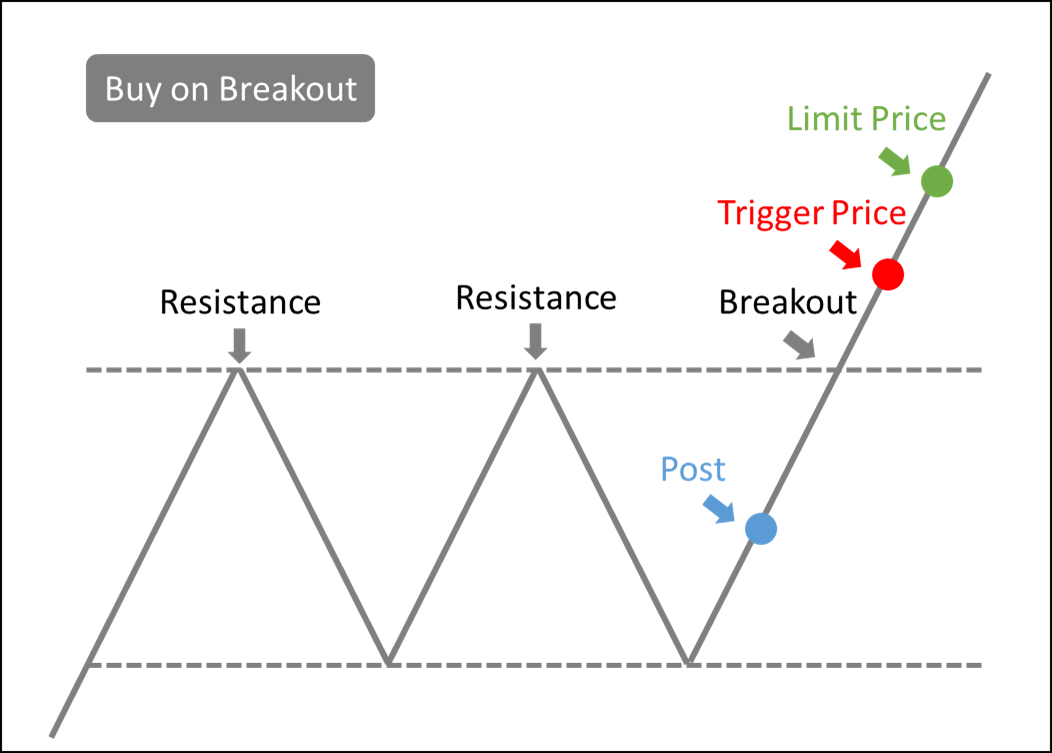

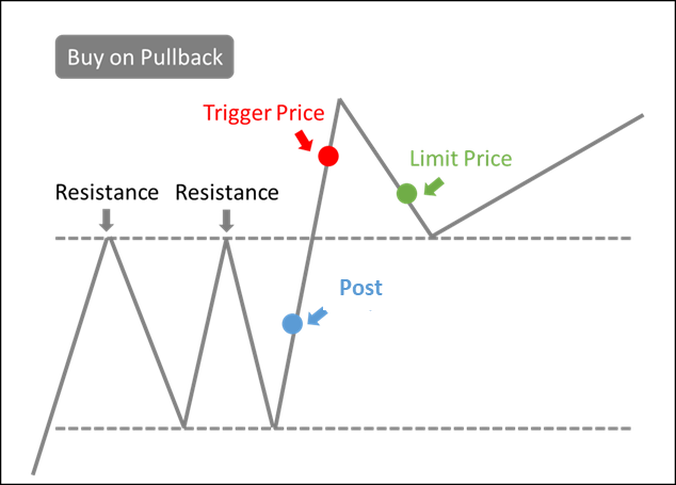

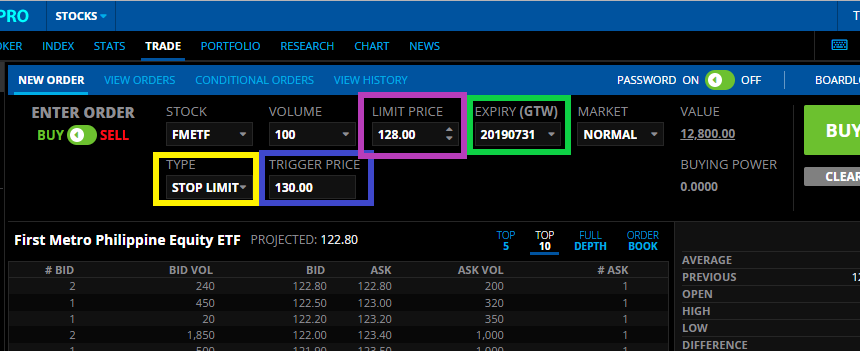

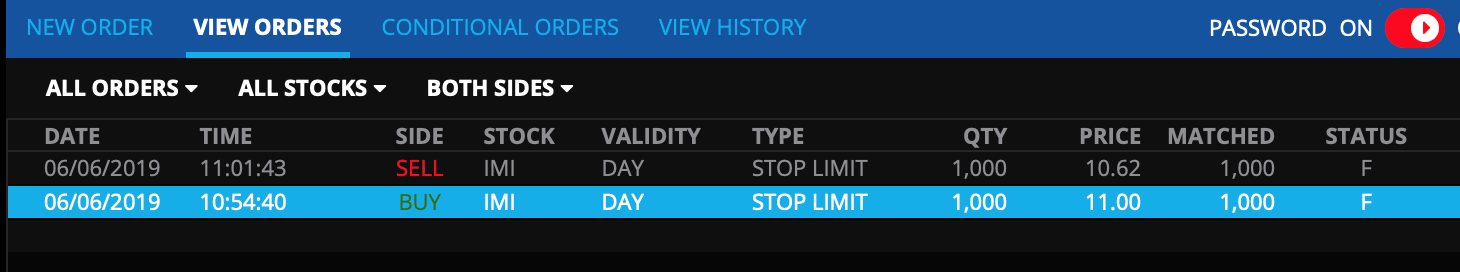

What is a Stop Limit? A Stop Limit is an invaluable tool for any trader. It can help you avoid risks and seize opportunities without having to closely monitor the market. A Stop Limit is an instruction to post a buy or sell order once the stock hits a specified price target (trigger price). Waiting time to hit the price target can be set to one day, one week, or one month. Once posted, your buy or sell order will only be filled at your specified limit price or better. Also, the buy or sell order must be filled before the end of the trading day or else the order will expire. Stop limit is only available in FirstMetroSec PRO. How do I post a stop limit? Posting a stop limit is easy! Simply login to FirstMetroSec PRO and click Trade > New Order. Then select STOP LIMIT under TYPE. A stop limit will require three important inputs: a trigger price, a limit price, and an expiry. Trigger Price is the price that must be reached by the stock before the order is posted. Limit Price is the price at which you want to fill your order, or better. Expiry is the length of time you are willing to wait for the stock to hit your trigger price. The expiry may be DAY, GTW or GTM. Why use Stop Limit when selling? Use Stop Limit to mitigate losses or protect gains in the event of a market decline. Sell at the precise moment the stock has reached your trigger price. And sell at the exact price you specified as your limit price or higher. No need to constantly monitor the market. With Stop Limit, you are forced to consider your exit strategy before the price drops with less emotion and more discipline. How do I use Stop Limit for selling? Mitigate Losses: Sell on Breakdown This ensures that possible losses are kept at a minimum by setting the limit to the losses you’re willing to take. To post a sell Stop Limit, set the trigger price below the current price. *Note: If you make the mistake of setting it at or above the current price, your order will be posted immediately and be treated like a regular sell order. Example: Let's say you just bought ABC stock at Php 100 because you believe the price is close to a major support level and will likely go up from here. You want to mitigate your losses just in case you are wrong by selling the stock when it hits Php 90 within one month. You want to receive no less than Php 80 for the sale. You may enter a sell stop limit with the following details: Enter Order: Sell Trigger Price: Php 90 Limit Price: Php 80 Expiry: GTM Remember that once the stock hits your trigger price within you specified expiry period and posted, the order must be filled within the day. The order will expire the next day if not fulfilled. Protect gains: Sell on Strength This strategy ensures that gains are locked before the price of the stock goes down. To post a sell Stop Limit, set the limit price above the trigger price. *Note: If you make the mistake of setting the limit price at or above the current price, your order will be posted immediately and be treated like a regular sell order. Example: Assume that you own shares of ABC stock which is currently trading at Php 100. To protect your gains, you want to be able to automatically sell the stock when it touches Php 90 within the week. But you are not willing to sell for less than Php 92. You may enter a sell stop limit with the following details: Enter Order: Sell Trigger Price: Php 90 Limit Price: Php 92 Expiry: GTW Remember that once the stock hits your trigger price within you specified expiry period and posted, the order must be filled within the day.The order will expire the next day if not fulfilled. Why use Stop Limit for buying? You can use buy Stop Limit to purchase a stock you expect to breakout soon at the precise moment the stock has reached your trigger price. You can do this without the need to constantly monitor the market. It also gives you the confidence that you will not pay more than your limit price if the stock moves up faster than expected. How do I use Stop Limit for buying? Buy on Breakout This strategy ensures that you can position yourself to buy a stock before it takes off. To buy on breakout, set the limit price above or equal to the trigger price. *Note: Remember to set the trigger price above the current price. If you set the trigger price below or equal to the current price, it will instantly activate your buy order. Example: Say you wanted to buy XYZ stock currently trading at Php 100 if it rises to Php 130 within one month. And you are willing to buy the stock up to the maximum price of Php 148. You may enter a buy stop limit with the following details: Enter Order: Buy Trigger Price: Php 130 Limit Price: Php 148 Expiry: GTM Remember that once the stock hits your trigger price within you specified expiry period and posted, the order must be filled within the day.The order will expire the next day if not fulfilled. Buy on Pullback This strategy ensures that you can position yourself to buy a stock when the price temporarily drops. To buy on pullback, set the limit price below the trigger price. *Note: Remember to set the trigger price above the current price. If you set the trigger price below or equal to the current price, it will instantly activate your buy order Example: Assume you wanted to buy XYZ stock currently trading at Php 100 if it rises to Php 130 within one week. But you want to buy it only if it pulls back to Php 128 or lower. You may enter a buy stop limit with the following details: Enter Order: Buy Trigger Price: Php 130 Limit Price: Php 128 Expiry: GTW Remember that once the stock hits your trigger price within you specified expiry period and posted, the order must be filled within the day.The order will expire the next day if not fulfilled. At what price will my Stop Limit be executed? One of the primary benefits of using stop limit is that once the trigger price is hit, the limit order is guaranteed to be placed in the market at the price you indicated or better. Selling Example: A sell stop limit order can be entered with a trigger price of Php 10 and limit price of Php 15 when a stock is trading at Php 20. If the price drops to Php 10, the sell order is automatically posted but not executed. The sale will not be executed until the price bounces back to Php 15 or higher. Buying Example: A buy stop limit order can be entered with a trigger price of Php 50 and limit price of Php 45 when a stock is trading at Php 30. If the price rises to Php 50, the buy order is automatically posted but not executed. It will not be executed until the price pulls back to Php 45 or lower. Is execution guaranteed for Stop Limit? A Stop Limit does not guarantee that an order will be filled after it has been triggered. Note that orders at each price level are filled in a sequence determined by the rules of the PSE. There is no assurance that all orders at a particular price limit will be filled when that price is reached. It may happen that there are not enough buyers/sellers at your limit price or better on the day your order is activated. Also, orders created by a Stop Limit remains in effect only for the day. It expires at the end of the trading day if not fulfilled. You are advised to monitor your pending conditional orders from time to time especially during volatile market conditions. Are there any restrictions on the setting of the trigger price? For buy stop limits, you must place the trigger price above the current market price. For sell stop limits, you must place the trigger price below the current market price. If you make the mistake of setting the trigger price in both instances, your order will be instantly posted and will be treated like a regular limit order. The trigger price may be set above, below or equal to the limit price. What time limitations can I place on a Stop Limit instruction? You can choose to have these instructions to remain open for the following durations: DAY. Stop Limit order remains open through the end of the trading day and will expire if the trigger price is not reached before the current day's market close. GTW. Stop Limit order remains open though the end of the week and will expire if the trigger price is not reached after seven calendar days. GTM. Stop Limit order remains open though the end of the month and will expire if the trigger price is not reached after thirty calendar days. Once the trigger price is reached, the stop limit order becomes a regular limit order to buy or sell. The limit order must be filled before the end of day, after which the order will expire if not fulfilled. Will the limit order created by a Stop Limit instruction expire? When that trigger price is reached on a Stop Limit order, the buy or sell order is automatically posted as a regular limit order. At that point, the limit order will remain active until the end of day. Any limit order created by a stop limit order will expire if not filled before the end of the day. How do I know the status of my stop limit order? To check the status of your pending Stop Limit orders on FirstMetroSec PRO, go to TRADE > CONDITIONAL ORDERS: P – Pending: stock has not hit your trigger price T – Triggered: stock has hit your trigger price X – Rejected: system has rejected your order Then, to check the status of the actual Orders after it was triggered and posted, go to Trade > View Orders: O – Open: posted order

PF – Partially Filled: partial volume has been matched C – Cancelled F – Filled: matched order R – Rejected Q – Queued: prompts before order is processed PRC – Processing: order is being set to/acknowledged by the exchange Can I enter a Stop Limit instruction when the market is closed? During Lunch Break? Yes as per First Metro Securities. A Stop Limit order can be entered during off-market hours, including market recess (12nn – 1:30PM). Can I cancel a Stop Limit order? Yes as per First Metro Securities. A Stop Limit order can be cancelled as long as it has not been triggered. Can I cancel a Stop Limit Order after it has been triggered? The Stop Limit order turns into a regular limit order once the trigger price is reached. The limit order can be cancelled as long as the order has not been matched in the market. Please note that LIMIT orders can only be cancelled during trading hours (9:30-11:30am and 1:30-3:30pm) Can I modify a Stop Limit order? No as per First Metro Securities. A Stop Limit order cannot be modified. Instead, you may cancel a Stop Limit order if it has not been triggered yet and submit a new one. Can I submit multiple Stop Limit orders for one stock? No as per First Metro Securities. Once you enter a sell stop limit order for one stock, the stock will be earmarked for that sell stop limit order. However, you can enter multiple buy stop limit orders as long as you have sufficient buying power. Example: If you have 100 shares of FMETF and you’ve entered a stop limit order with a trigger price of Php 100 to sell 10 shares at Php 99, you can only now take additional action on the other 90 shares. What are the risks of using Stop Limit? As with all limit orders, there is no guarantee that the order will be filled when triggered. The stock’s price may move away from the specified limit price, which occurs in a fast-moving market. Short-term price fluctuations can also activate a Stop Limit order, so trigger price and limit price should be selected carefully. Are Stop Limit Orders sent to the market? Only the Limit order is sent to the market once the trigger price is reached. Stop Limit Ordering is a feature of FirstMetroSec PRO and is contained in its system. If you have any concern or questions, you may reach First Metro Securities at [email protected]. Note: Images and information are from First Metro Securities. You may read related topic: How To Open An Online Stock Trading Account Using FirstMetroSec (Firt Metro Securities)

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |