Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

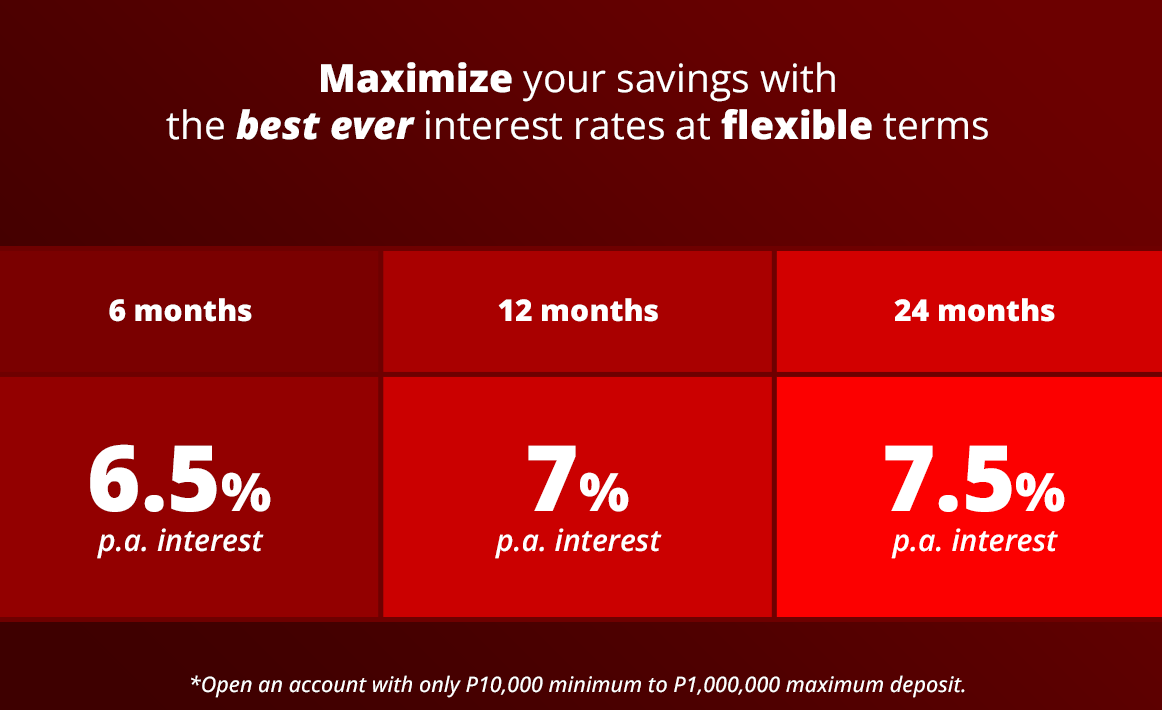

CIMB Bank rolls out its new time deposit with the highest interest rate in the market, up to 7.5% per annum, with terms ranging from 6 months to 24 months. What's new with the CIMB Bank Next Gen Time Deposit? What is a MaxSave Time Deposit account? By keeping your money with the bank for a predetermined period of time, a MaxSave Time Deposit account is a lock-in savings account that gives you a higher interest rate than a regular savings account. What are the available terms for MaxSave Time Deposit? There are three options for tenure: six, twelve, and twenty-four months. A minimum principle amount of Php 10,000 and a maximum principal amount of Php 1,000,000 can be deposited. What are the benefits of this savings account?

How many time deposit accounts am I allowed to open? Have as many accounts for each of your savings goals. You can open up to five time deposit accounts, one for each savings goal you want to fund. Where will I get the interest earned on my MaxSave Time Deposit account? Upon maturation of your MaxSave Time Deposit, the savings account that you selected during onboarding will become your settlement account. However, you may also choose to select another savings account anytime until a day before the maturity date. You are permitted to have the same linked savings account open at the same time as another if you have opened several MaxSave Time Deposit accounts. Who is eligible to open a MaxSave Time Deposit account?

One of the following IDs can be presented at least once during the virtual verification stage:

You are set to go if you fulfill all of the prerequisites listed above! Just make sure there are enough funds in the savings account of your choice to cover the required initial principle amount. How can I apply for the MaxSave Time Deposit? Opening an account is very simple! Just follow the steps below. Step1: Make sure you already have CIMB Bank PH Mobile App. Open the CIMB Bank PH app and select "Open an Account" then choose "MaxSave Time Deposit." Step 2: Read the Terms and Conditions, tick the box, and tap on "I Agree." Step 3: Key-in the principal amount you want to deposit and select from the available terms. Once done, tap "Continue." Step 4: Set up your MaxSave Time Deposit account by assigning a nickname and selecting the savings account where you want your principal and interest to be credited. Then tap "Continue." Step 5: Verify the details of your new account by reviewing the details on the screen and clicking "Continue." Congratulations! You have successfully created a MaxSave Time Deposit Account! For more information about this latest offering from CIMB Bank, you may visit their official website at www.cimbbank.com.ph. You may also look for their official mobile apps on Google Play, the Apple Store, and Huawei AppGallery.

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |