Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

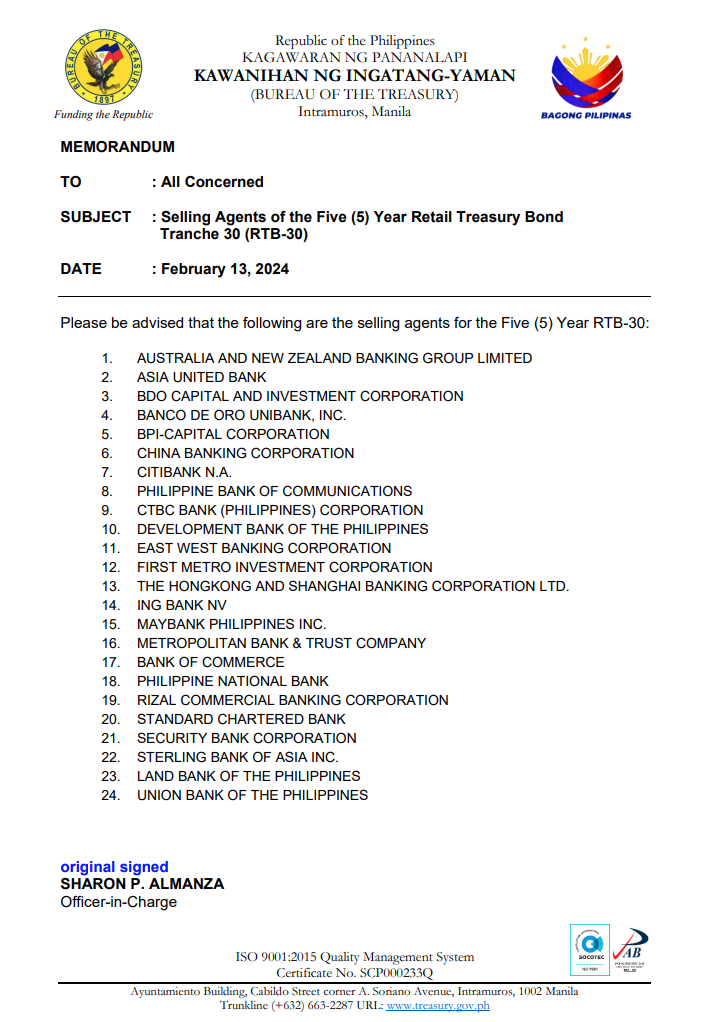

The Bureau of the Treasury (BTr) launched the 30th offering of its Retail Treasury Bonds (RTB 30) with a tenor of five (5) years and a gross interest rate of 6.25% per annum with quarterly coupons payable until its maturity in 2029. The RTB 30 coupon was set with a spread of 11.46 basis points over secondary market rates, the lowest among the nine RTBs issued since 2019. A total of Php 212.7 billion was raised during the auction, more than seven times the initial target amount of Php 30.0 billion. RTBs are fixed-income instruments issued by the National Government that are low-risk, affordable, and convenient. Purposely designed for retail investors, Filipinos may invest in RTB 30 for as low as Php5,000 and in multiples of Php 5,000 thereafter. The offer period for RTB 30, the BTr’s first Peso-denominated retail issuance for the year, will run from February 13 to 23, 2024, with the issue date scheduled on February 28, 2024, subject to the discretion of the BTr. With its campaign dubbed “Kaagapay mo sa buhay,” RTB 30 serves as an invitation for everyone to participate in shaping the country’s shared future. By investing in RTB-30, investors are given the opportunity to directly contribute to the essential funding of the National Government’s key projects in infrastructure, agriculture, healthcare, and education, among others, all in the hopes of building a better future for every Filipino. To officially launch the public offer period, Finance Secretary Ralph G. Recto mentioned that “The RTB 30 is more than just a financial contract but a commitment to shared prosperity. It will help drive the government’s socioeconomic agenda forward and empower ordinary Filipinos to chart their path to financial freedom for a more secure future. Nagpapakita ito ng isang klase ng gobyerno na handang umalalay sa mga Pilipino tungo sa pag-asenso, sa murang investment na limang libong piso." "We at the BTr are forever grateful to our partner institutions and the investing community for their continued support of the RTB program. While much has changed since the first RTB offering, the RTB program has withstood the test of time through our collective efforts. Moving forward, we will continue to work with our partners and stakeholders to strengthen the RTB program even further." said OIC Treasurer Sharon P. Almanza. Since its maiden issuance in 2001, RTBs have promoted financial literacy and inclusion among Filipinos. Over the last two decades, BTr has consistently demonstrated its commitment in making RTBs easily accessible to the broader investing public. Aside from the traditional over-the-counter subscription through authorized Selling Agents, the public may now use the BTr’s Online Ordering Facility on its website - www.treasury.gov.ph. The online facility is open to account holders of China Banking Corporation, Development Bank of the Philippines, First Metro Securities, and Land Bank of the Philippines. Other options include mobile banking applications (MBAs) of the Land Bank of the Philippines MBA, the Overseas Filipino Bank MBA, and the Bonds.PH mobile application which is available on most platforms. Similar to recent RTB issuances, the BTr will also be conducting the Switch Program, wherein holders of eligible bonds (RTB 03-11 and RTB 05-12) may be able to seamlessly exchange their holdings for RTB 30. Investors who will participate in the RTB-30 Switch Program shall receive interest on their eligible bonds that will accrue until the issue date of RTB 30. The Development Bank of the Philippines and the Land Bank of the Philippines are the Joint Lead Issue Managers for the RTB 30 offering and are joined by BDO Capital & Investment Corporation, BPI Capital Corporation, China Bank Capital Corporation, First Metro Investment Corporation, PNB Capital and Investment Corporation, and Union Bank of the Philippines as Joint Issue Managers. Further, the Selling Agents for the RTB 30 offering include Australia and New Zealand Banking Group Limited, Asia United Bank, BDO Capital and Investment Corporation, Banco De Oro Unibank, Inc, BPI-Capital Corporation, China Banking Corporation, Citibank, N.A., Philippine Bank of Communications, CTBC Bank Corporation, Development Bank of the Philippines, East West Banking Corporation, First Metro Investment Corporation, The Hongkong and Shanghai Banking Corporation LTD., ING Bank NV, Maybank Philippines INC., Metropolitan Bank & Trust Company, Bank of Commerce, Philippine National Bank, Rizal Commercial Banking Corporation, Standard Chartered Bank, Security Bank Corporation, Sterling Bank of Asia Inc, Land Bank of the Philippines, and Union Bank of the Philippines. Interested investors may visit the BTr’s website at www.treasury.gov.ph for more information on this issuance. You might also be interested in reading about these related topics:

What are Retail Treasury Bond (RTBs) and How to Invest? How to Register in Bonds.PH and Start Investing in the Philippine Bonds What are Retail Onshore Dollar Bonds? And How to Invest in RDBs?

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |