Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

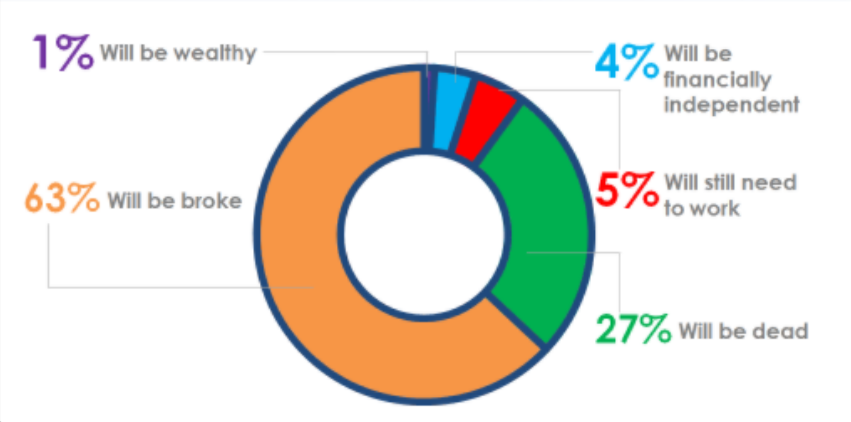

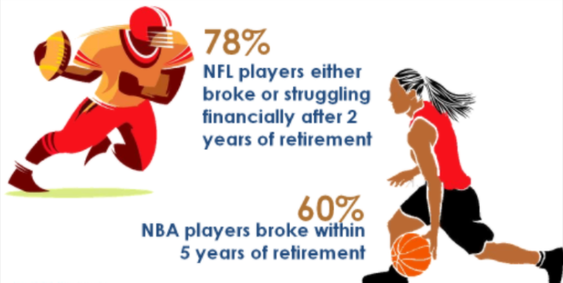

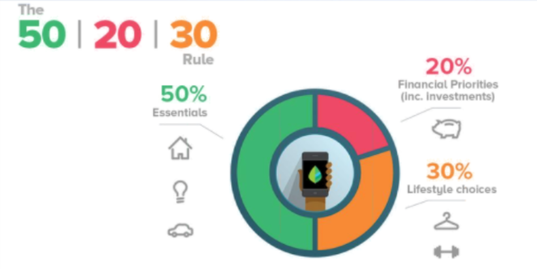

An investor without investment objectives is like a traveler without a destination. An investor's worst enemy is not the stock market but his own emotions. To be a successful investor, you have to be emotionally neutral to winning and losing. Winning and losing are just part of the game. Learn the habits of happy investors. So, what are the 10 Habits of Happy Investors? Keep on reading! Habit 1: Invest Consistently When 25-year-olds today reach 60. Remember this, a High Paying Job ≠ Financial Security Don't get me wrong but someone with a higher-paying job is not necessarily better off. How Much Should I Set Aside? Remember the 50|20|30 Rule Invest at least 20% of what you earn! Tips On How To Stay Disciplined

Invest Continuously When getting a bonus or pay increase

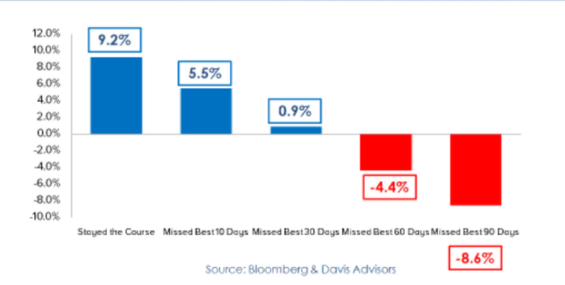

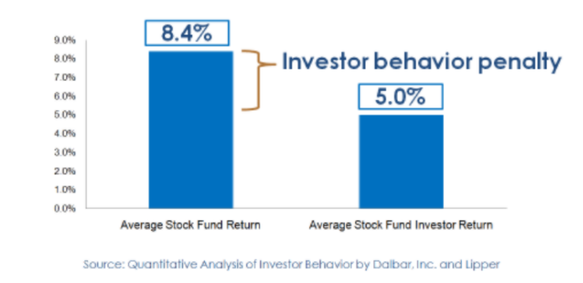

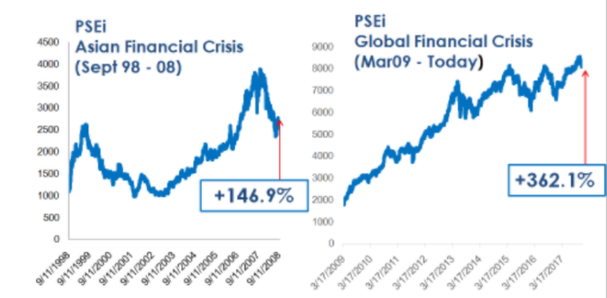

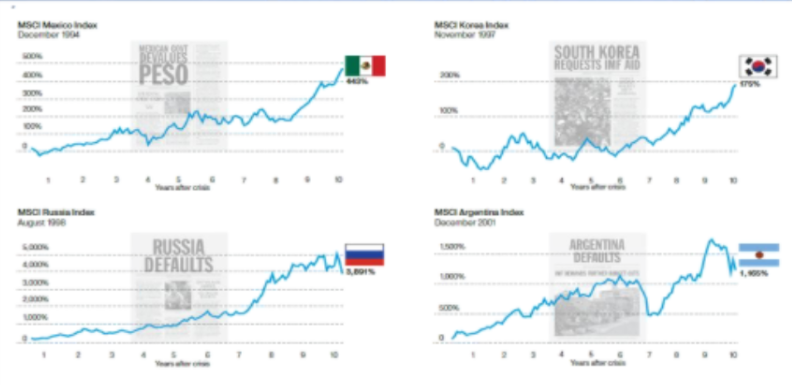

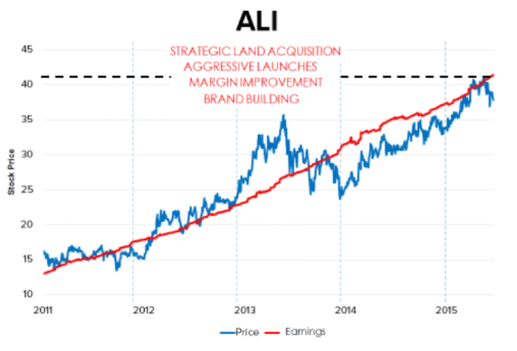

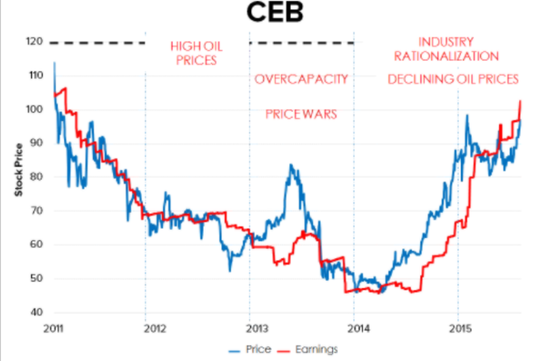

Differentiate between needs and wants Buy what you want, only when you have set aside enough for your investments. Habit 2: Avoid Timing The Market When the market corrects, investors usually sell their positions with intention of buying back when the market recovers. Danger of Trying to Time the Market (1994 - 2013, S&P500) Danger of Trying to Time the Market (1996 - 2016, PSEi) Habit 3: Avoid Being Emotional Looks familiar? Average Stock Fund Return Vs. Average Stock Fund Investor Return (1994 - 2013) Habit 4: Accept Volatility There are so many reasons why stocks can go down in value. We can choose to react positively or negatively. Habit 5: Buy When The Market Goes On Sale Normal human behavior The happy investor's behavior. Be fearful when others are greedy. When there is blood on the street, I am buying. Habit 6: Do Your Homework Sustainable share price drivers. Profits Where are profits headed? Valuations What is being reflected in the price? An example, ALI (Ayala Land, Inc.) Another example, CEB (Cebu Pacific) Do your homework!

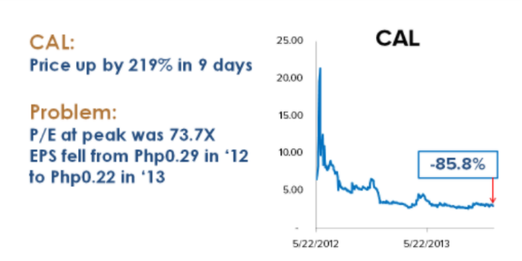

Danger of buying Penny Stocks

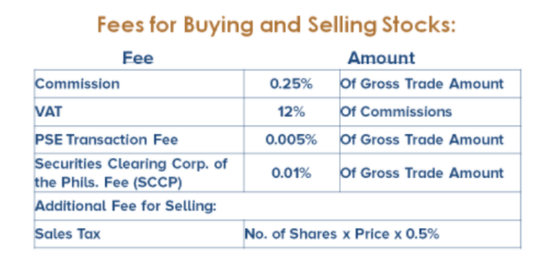

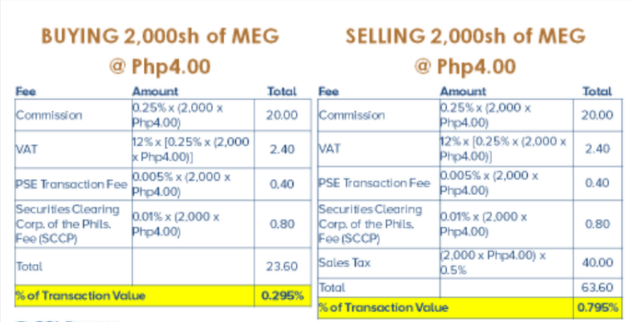

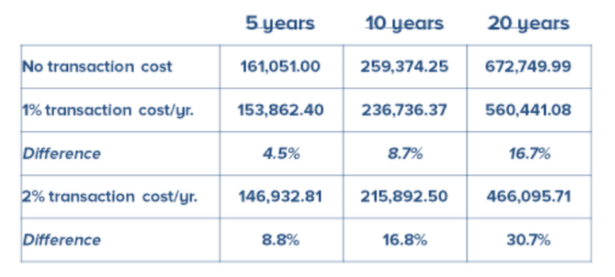

Case Study: CAL (CALATA Corporation) Habit 7: Be Cost Conscious Active trading is very costly. Total Transaction Cost (Buy and Sell) = 1.09%! Beware of high cost financial products! Examples of Fees:

Value of Php 100,000 invested today yielding 10% p.a Habit 8: Diversify Diversification helps manage risks! Basic types of diversification

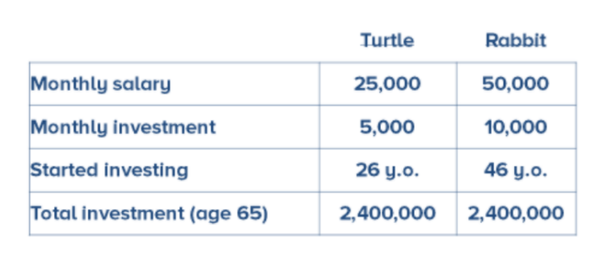

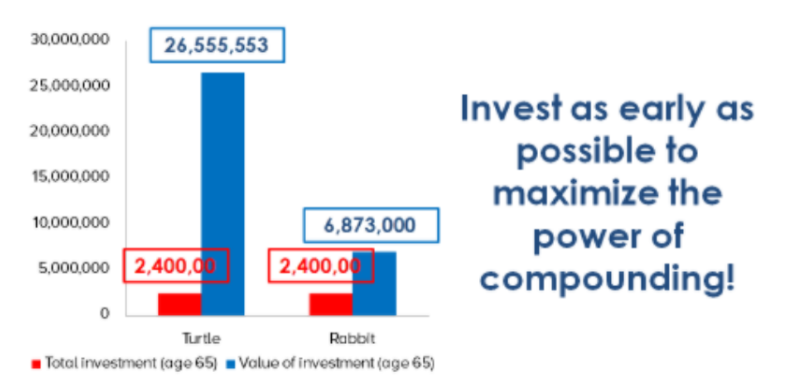

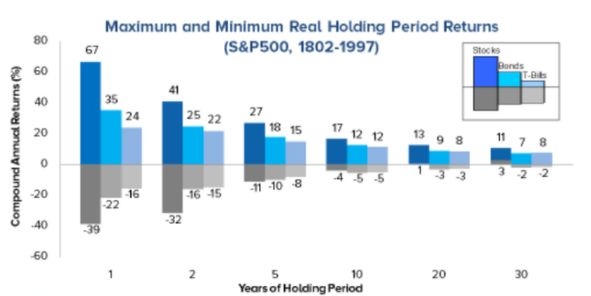

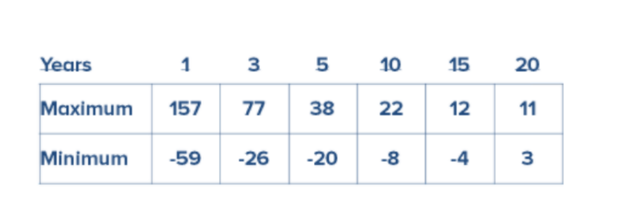

Habit 9: Think Long Term The importance of Time Horizon The Turtle Investor beats the Rabbit Investor by a wide margin! Risk of losses diminishes in the long run. Maximum and Minimum Nominal Holding Period Returns (PSEi, 87 - 16) Habit 10: Review Your Invesment Portfolio

Example of an annual review check list:

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |