Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

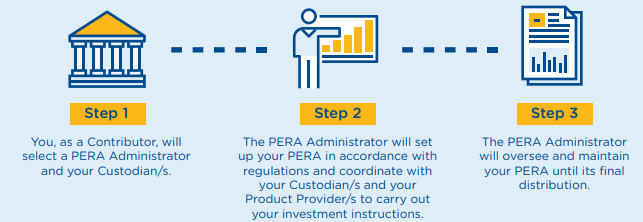

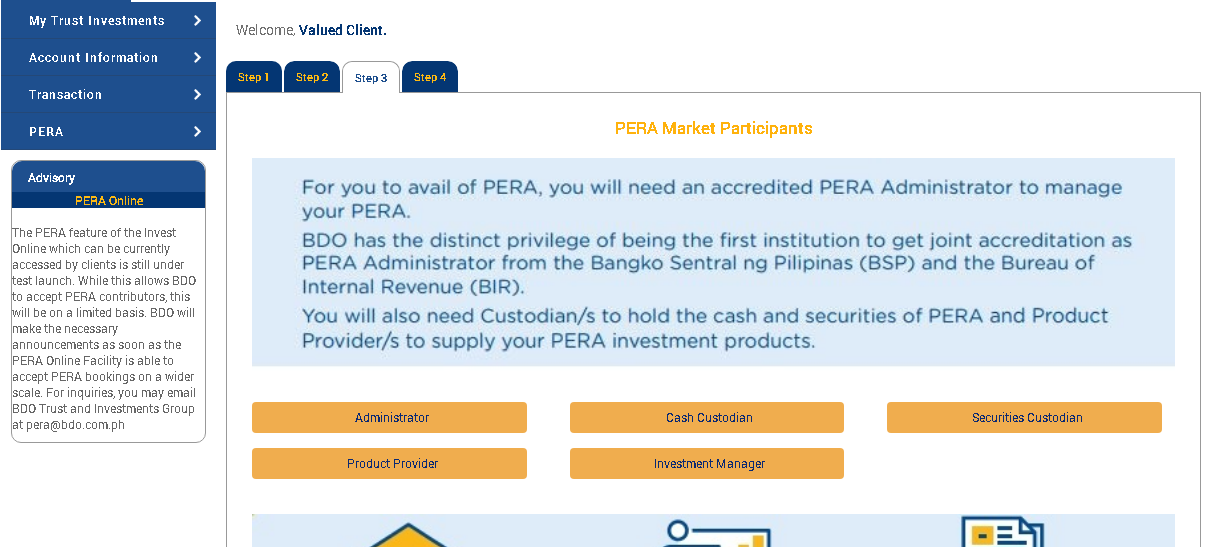

Did you know? There is no better time than now to start planning your retirement. PERA can help you gift yourself with a more comfortable retirement. What Is PERA? PERA is short for Personal Equity and Retirement Account under Republic Act No. 9505. It refers to a voluntary retirement account established by and for the exclusive use and benefit of the Contributor for the purpose of being invested solely in PERA investment products in the Philippines. It aims to promote capital market development and savings mobilization by establishing a legal and regulatory framework of retirement plans for persons. How Does PERA Work? For you to avail of PERA, you will need an accredited PERA Administrator to manage your PERA. BDO has the privilege to get joint accreditation as PERA Administrator from the Bangko Sentral ng Pilipinas (BSP) and the Bureau of Internal Revenue (BIR). You will also need Custodian/s to hold the cash and securities of PERA and Product Provider/s to supply your PERA investment products. BDO's PERA Investment Products Aside from being a PERA Administrator, BDO is also a Product Provider. You may select from the following BDO PERA Unit Investment Trust Funds (UITFs):

BDO's PERA Opening Requirements Any interested PERA Contributor should:

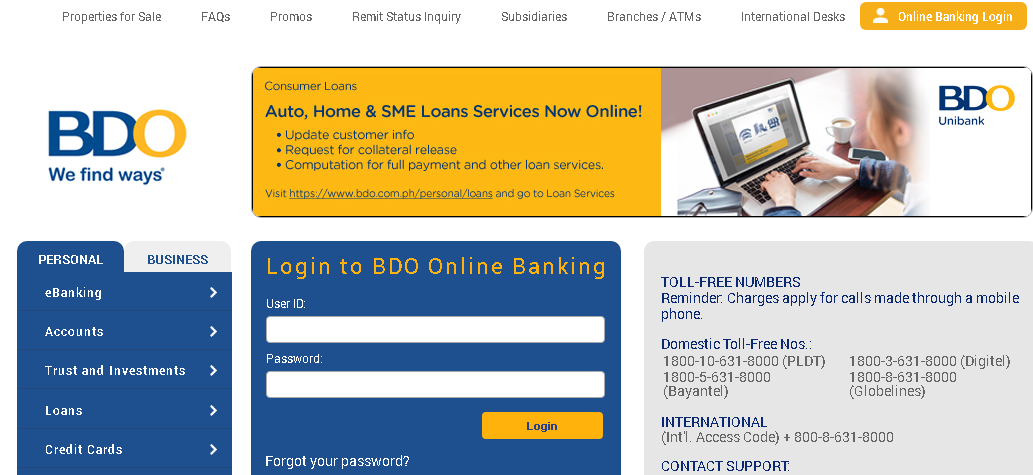

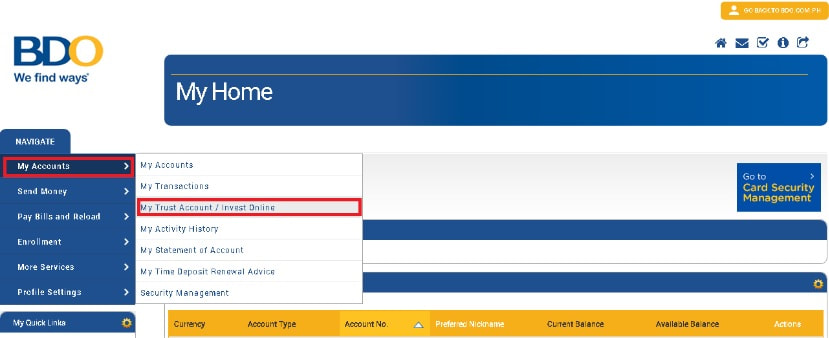

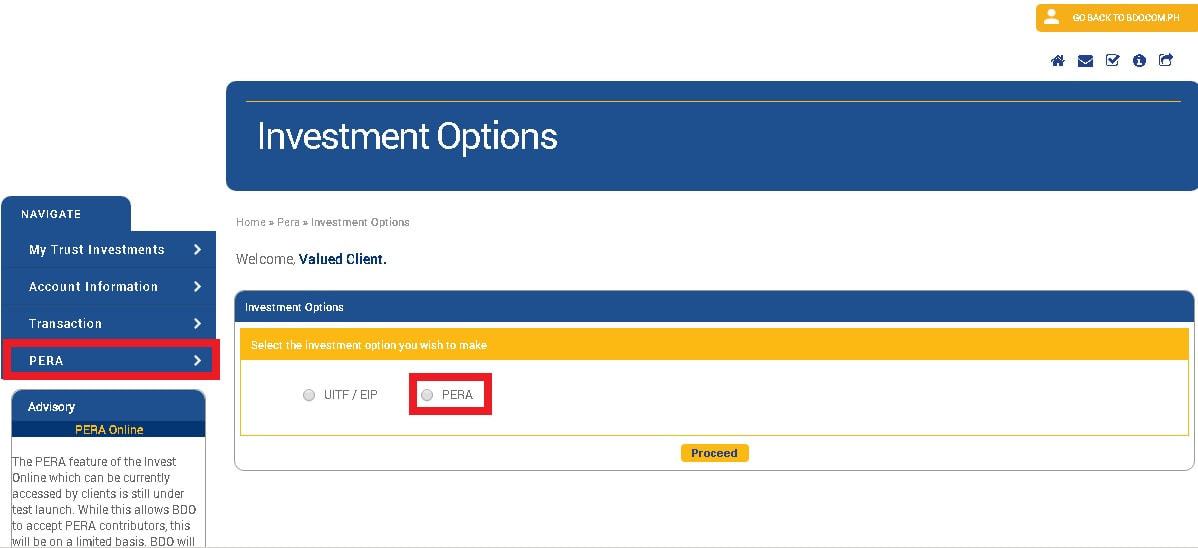

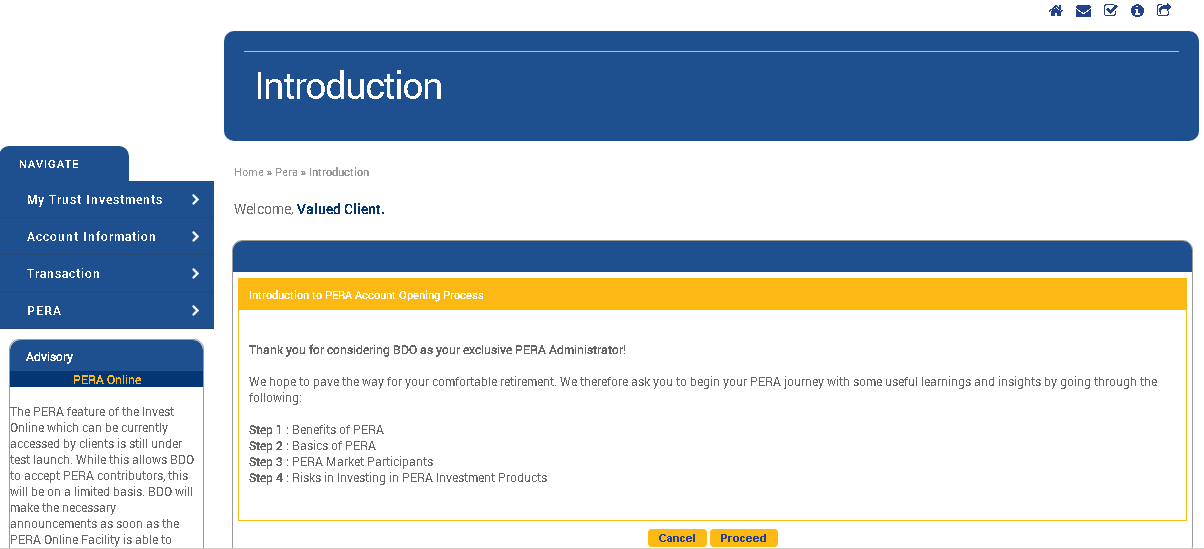

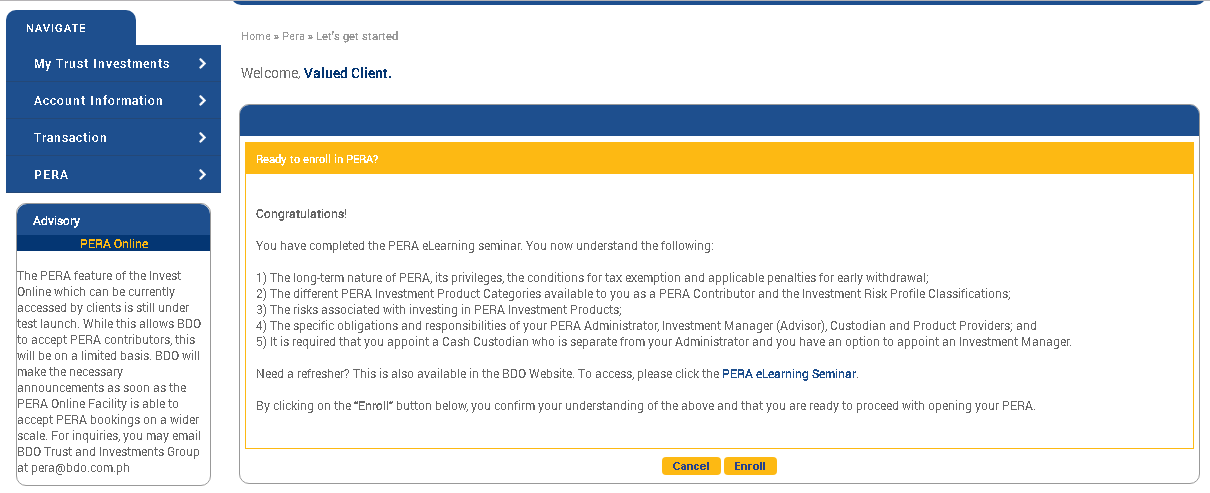

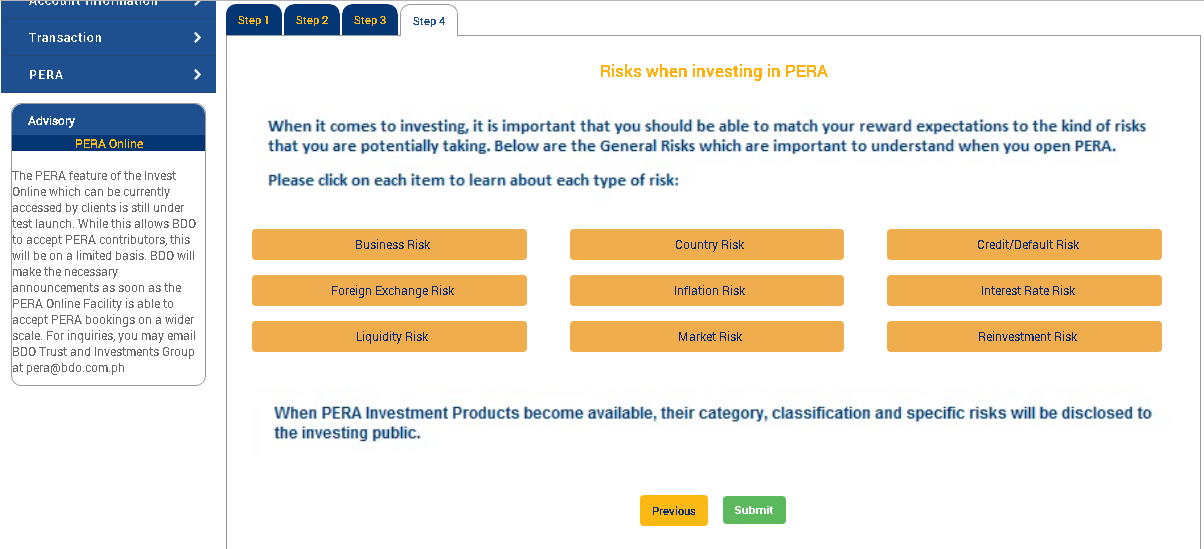

- Employer's Name How To Enroll Online? 1. First, login to your BDO Online Banking account. Simply go to www.bdo.com.ph, look for the Online Banking button on the upper right corner, and follow the enrollment procedure. 2. Go to my "My Accounts" on the sidebar navigation menu, then click "My Trust Account/Invest Online" 3. Click the "PERA" tab then choose "PERA" option button. Click "Proceed". 5. Click the "Submit" button.  . 6. To enroll, click the "Enroll" button. Disclosures

*UITFs are trust products and are not deposit products. They are not covered by the Philippine Deposit Insurance Corporation (PDIC). The units of participation in the UITFs when redeemed, may be worth more or worth less than the client's initial investment.

1 Comment

|

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |