Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

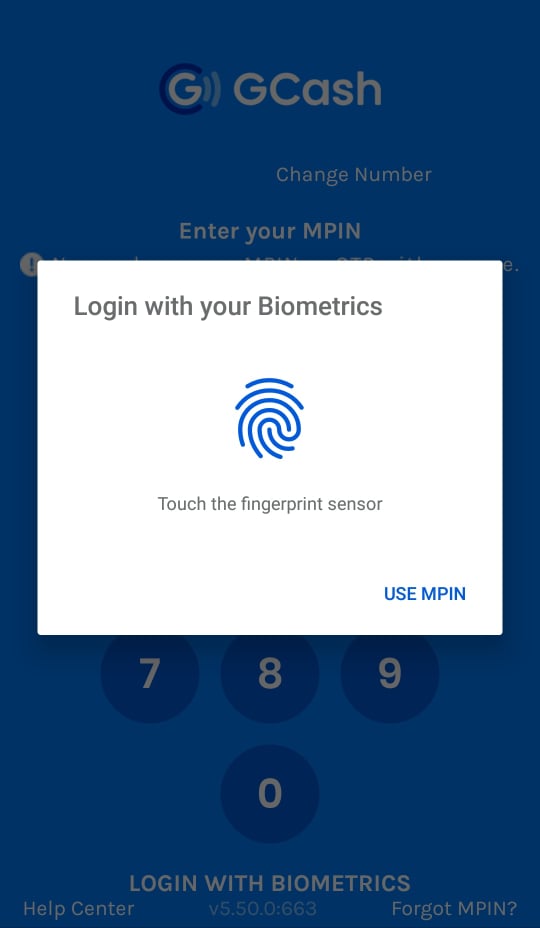

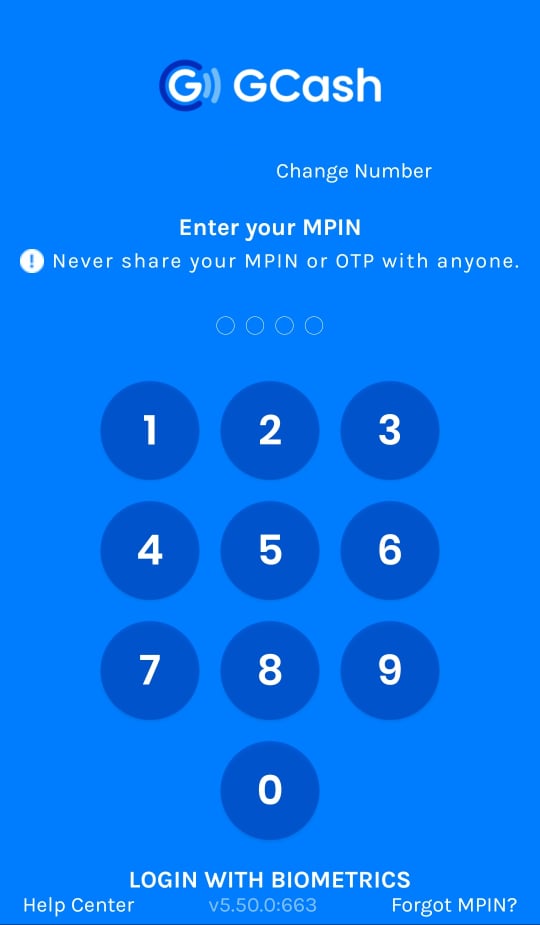

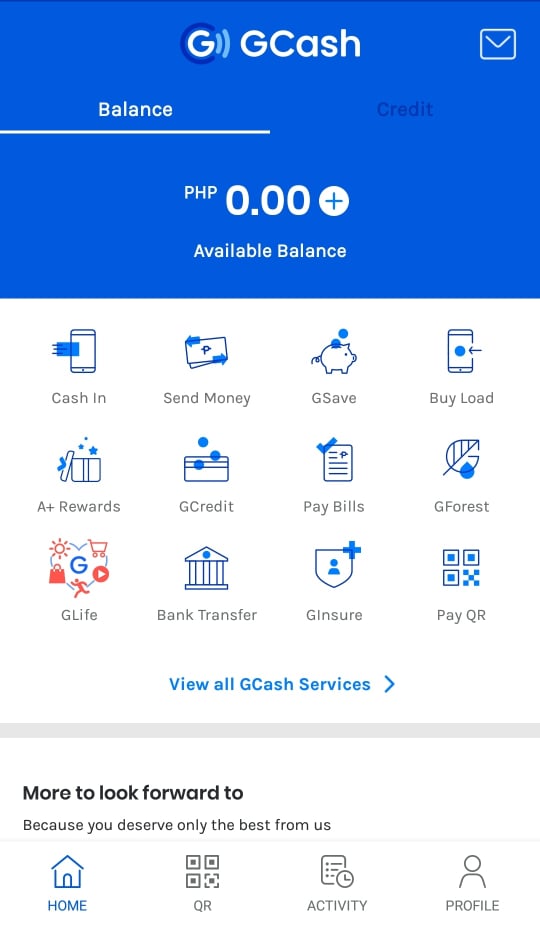

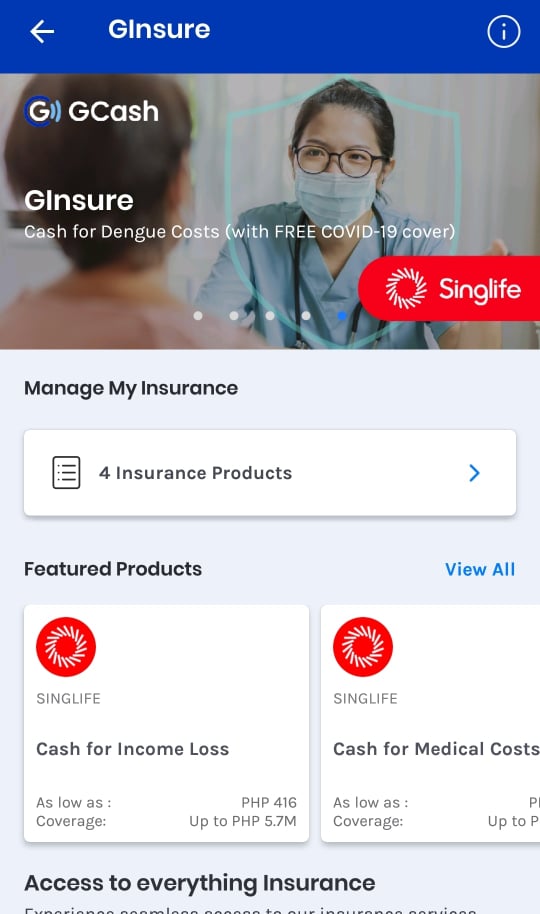

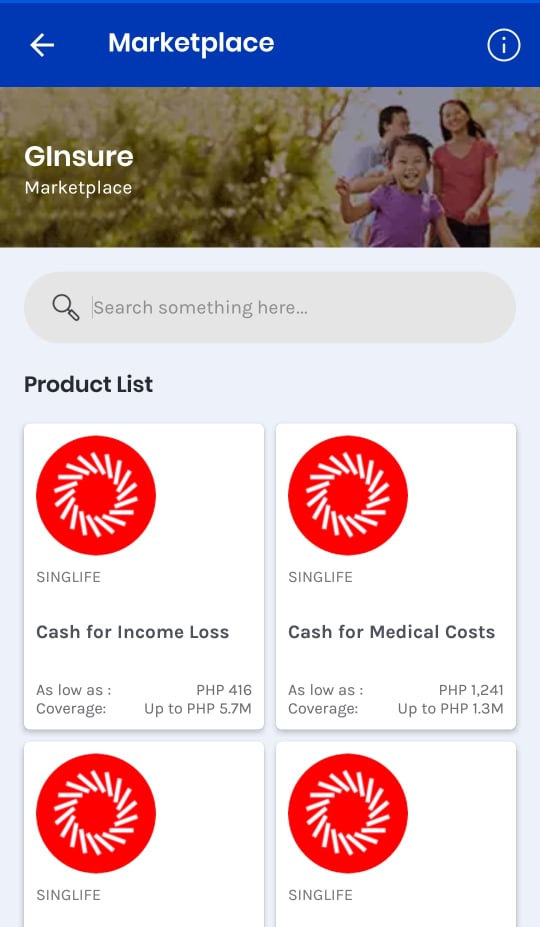

Be ready for anything life throws at you! Get insured! Is getting insurance a necessity? Buying insurance is important as it ensures that you are financially secure and ready to face any unexpected problems in life. This is one of the reasons, why insurance is an important part of financial planning. Talking about insurance, did you know that it is easier to buy insurance now? With the help of the GCash Mobile App, you can buy insurance for yourself, your family, your car, and even your pet dog. I wanted to buy insurance, and I’ve been looking for it for a long time. How do I buy insurance with the GCash Mobile App? If you are uninsured and you are just a beginner, or you are a long-time user of the GCash Mobile App, but you have not explored it much. Here are some steps on how to buy the insurance you need. 1. If you do not yet have the GCash Mobile App, you can download it on the App Store (this is for iPhone users) and on Google Play (this is for Android users). Note: If you have an existing GCash Mobile App, skip this first step. 2. If you have already modified your fingerprint security feature in the GCash Mobile App, you will log in using the fingerprint security feature. Alternatively, you can use the MPIN (Mobile Personal Identification Number). 3. After your login is successful, you will proceed to its dashboard. Here you will find all the services offered by GCash Mobile App. Find the GInsure service. If not, go to View all GCash Services. 4. It will then direct you to GInsure, where from here you will find all kinds of insurances that you can buy. To see them all tap, View All in Featured Products. Right now, the available types of insurances that you can buy are as follows: Singlife

- Coverage up to Php 5.7M

- Coverage up to Php 1.3M

- Coverage up to Php 421.5K

- Coverage up to Php 5.7M Lifestyle

- Coverage up to Php 150K

- Coverage up to Php 30K

- Coverage up to Php 30K

- Coverage up to Php 100,000 Kwik.insure

- Coverage up to Php 8.8M

- Coverage up to Php 100K FPG Insurance

- Coverage up to Php 115K

- Coverage up to Php 100K

- Coverage up to Php 50,000 BPI MS Insurance

- Coverage up to Php 100K Cebuana Lhuillier

- Coverage up to Php 10K

- Coverage up to Php 50K

- Coverage up to Php 50K Standard Insurance

- Coverage up to Php 5M

- Coverage up to Php 100K Pru Life UK

- Coverage up to Php 100K 5. Choose insurance that suits your needs. And follow the process on how to buy. It's so easy, isn't it? Insurance is very important and can help a lot not only for yourself but also for your family. Always remember,

0 Comments

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |