Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

Saving should be done consistently and as a priority as early as possible, even in small amounts. Every little bit counts, so rather than looking for one big way to save a ton of money, save in lots of small ways and set yourself up for success. If you make financial decisions with immaturity, you will be broke your whole life. The table below is a sample financial guide that will help you manage your finances. STEP 1: List Your Savings Goals Name:

STEP 2: List All Your Income Source And Expenses Month of:

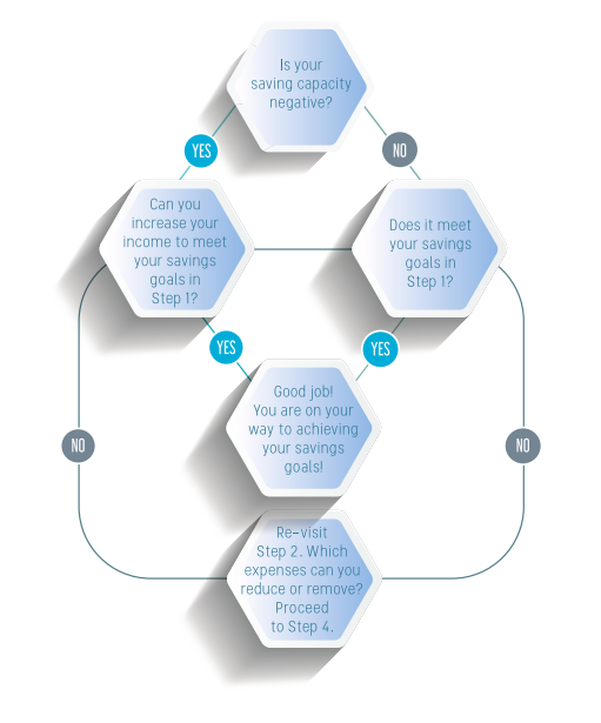

STEP 3: Find Out Your Saving Capacity

STEP 4: Write Your Action Plan To Reach Your Savings Goals 1. I will not spend on entertainment. 2. I will reduce aircon consumption to save on electricity bills. 3. I will find additional sources of income. Tips To Save Successfully

Create And Follow A Reasonable Budget List expenses. Allocate a reasonable budget for each. Use it to guide your spending. Save First Set aside a portion of your income in a savings account. Spend the remainder on your needs. Spend Less Than What You Earn Live below your means. Prioritize needs. Cut down on wants.

1 Comment

12/7/2023 09:59:36 pm

I like that you said that having savings goals could help provide the best financial planning approach. A few nights ago, my best friend mentioned that he and his wife are looking for a financial plan that could help them manage their money and financial wealth properly to prevent financial loss in the future. He asked if I had any suggestions on the best planning approach. Thanks to this helpful wealth management guide article for the best financial planning. I'll tell him that consulting a trusted financial planning service can help them with more information about the process.

Reply

Leave a Reply. |

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |