Personal Development, Business, Finance, and Investing for Everyone

An investment in knowledge always pays the best interest.

|

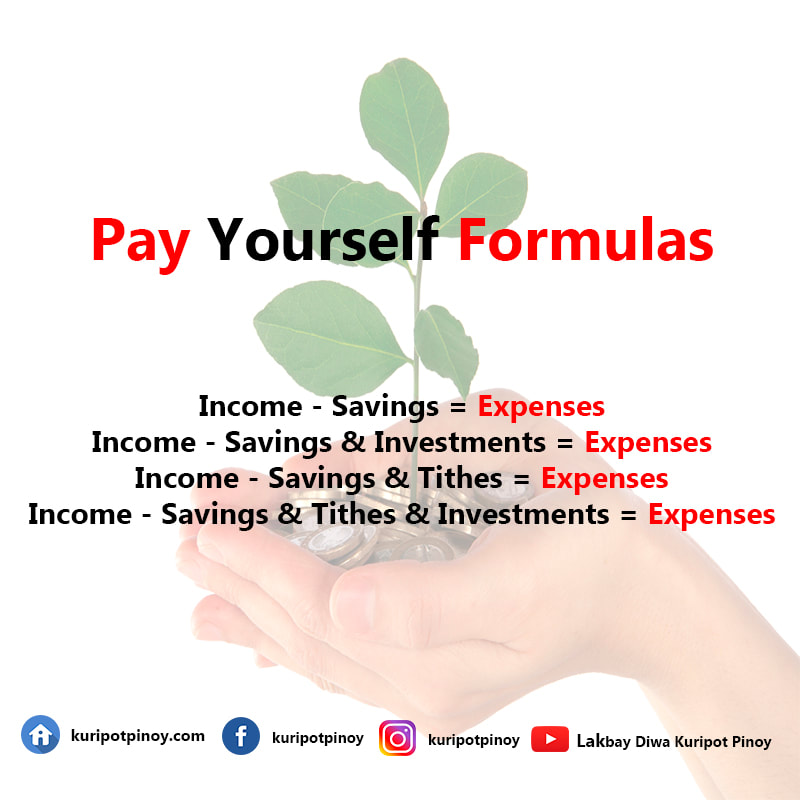

As the saying goes, "Beware of little expenses. A small leak will sink a great ship." The earlier a young person can save and invest for their future while avoiding financial pitfalls like expensive bad debt, the greater financial flexibility they will have throughout their life to pursue their dreams. So here are 10 Ways To Grow Your Personal finances: Start Today Saving is not an option but a priority. It is important that you start today rather than tomorrow. Remember that time is as precious as money. If you waste time, you waste money. Eliminate Your Debt A credit card is one of the most tempting portals to bigger expenses. In order to launch an effective personal finance plan, you must pay your bills first. Differentiate Your Wants And Needs This is a state where self-discipline is tested. Differentiating between what you want and what you need relies on how you perceive things. Impulse spending should be avoided. Don't Spend Beyond Your Earnings Expenses start to bloat if you spend more than you have. Learn to plan your budget and live with it. Don't aim for a bigger income just to spend more; aim for wealth to prepare for your future and goals. Pay Yourself First It is important that, regardless of your expenses and needs, you also pay yourself at least a minimum of 10% of your take-home pay. If you have an income of PhP 10,000 per month, you should have at least PhP 1000 in savings each month. Don't wait for the time that you have to ask yourself, Where is it now? The right formula should be either of the following: Income - Savings = Expenses Income - Savings & Investments = Expenses Income - Savings & Tithes = Expenses Income - Savings & Tithes & Investments = Expenses Set Financial Goals You set your goal in accordance with your lifestyle. They are compatible with each other. Take note that no one can set these goals for you. Be A Responsible Decision Maker Educating yourself about financial management is one of the most effective ways to become wealthy. But still, your money will always be your sole responsibility. You need to learn how to manage your finances accordingly. Save And Invest Your money is like a tree. If you save and invest, it will grow and provide an extra income. But just like a tree, if you don't take care of it, it will eventually wither and vanish. You can put your savings into an investment or an emergency fund. Protect Your Finances

No matter how wealthy you are, you are not safe from a financial crisis. You must learn how to protect your finances with insurance bonds. With the perfect provider, you can protect your properties, assets, and even your health against unfavorable circumstances. Time To Give Back Always be thankful for your blessings in life. You can show charity by any means, such as donating to worthy causes or providing volunteer services.

1 Comment

|

PLACE YOUR ADS HERE YOUR PAYDAY REMINDER FEATURED PARTNER FEATURED PROMOTIONS FEATURED MENTIONS PLACE YOUR ADS HERE PLACE YOUR ADS HERE For more updates about Personal Development, Financial and Investment Education. Join and Subscribe to my Newsletter. It's FREE! ABOUT THE BLOGGERHi, I'm Ralph Gregore Masalihit! An RFP Graduate (Registered Financial Planner Institute - Philippines). A Personal Finance Advocate. An I.T. by Profession. An Investor. Business Minded. An Introvert. A Photography Enthusiast. A Travel and Personal Finance Blogger (Lakbay Diwa and Kuripot Pinoy). Currently, I'm working my way toward time and financial freedom. PLACE YOUR ADS HERE Follow me on |